Wen| Industrialist, author| Sihang, Editor| Peet

Whether it is driverless driving or embodied intelligence, neither is a new concept. The listing boom and financing boom seen today are only the tip of the iceberg. Under the iceberg, what is truly favored by capital is still the specific application rooted in vertical industries. The rise of AI models has allowed capital to see their commercial value again.& nbsp;

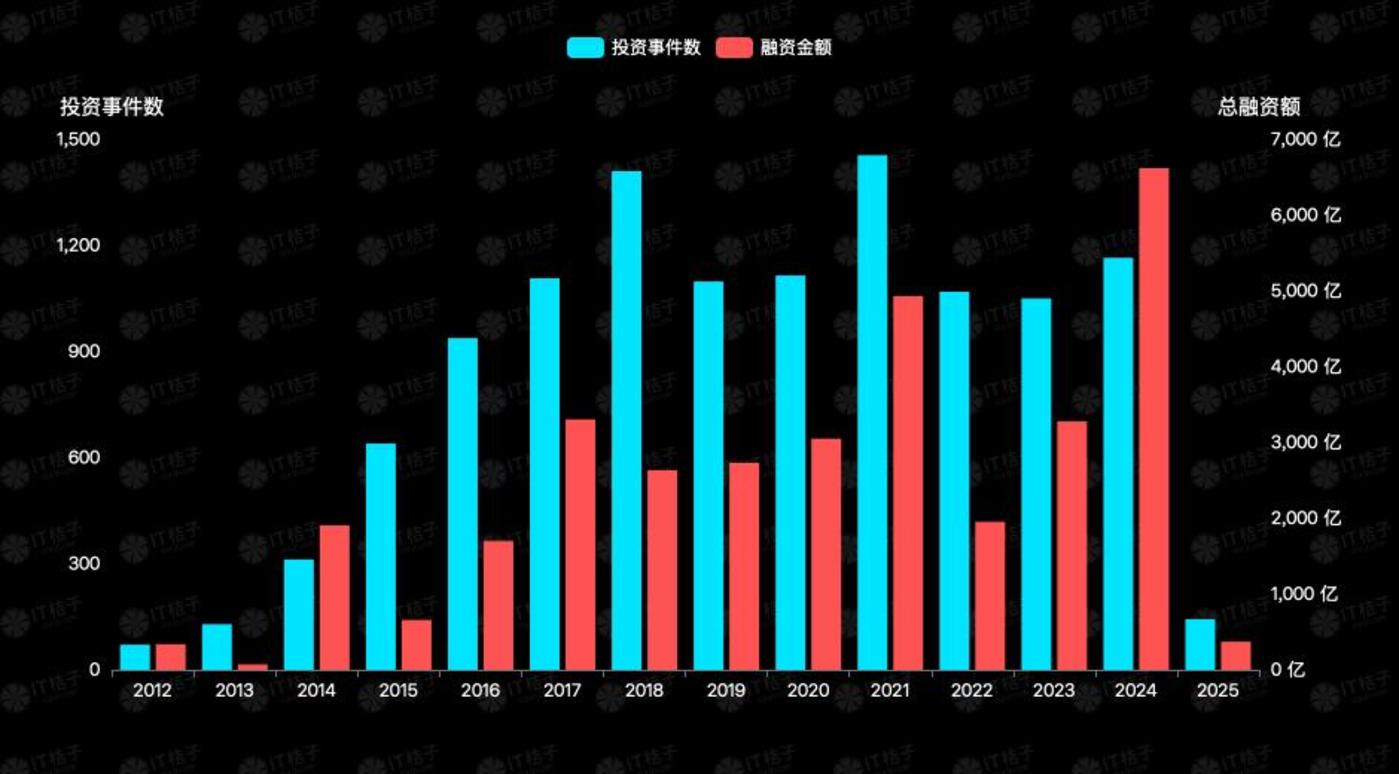

A surge of 101.9%, which is the answer given by capital in the AI field in 2024.

According to industry statistics, in 2024, the amount of financing in the AI field will reach 661.9 billion yuan, a year-on-year increase of 101.9%; however, the number of investment events is not much different from the previous year. Sequoia China, the well-known investment institution that makes the most frequent investments in AI projects, has doubled its investment amount in the past year, while the amount of investment has dropped by 55.6% year-on-year. It can be seen that it is among the investors of many star AI companies.

However, the above is not the complete picture of the capital narrative in 2024. There are other signals hidden under the iceberg. If things were to go as usual, 2025 should have reached a huge fork in the road.

But in early 2025, DeepSeek took out a king’s card and disrupted the original story.

In the AI field in 2024, what narrative has capital described? In the next year, where is the new rudder heading? Or, what kind of story context is the new AI story showing?

1. Sequoia China makes frequent moves.Tencent and Ali compete for star AI company

From the beginning of 2023 to the present, the large model that has lasted for two years has not only failed to extinguish the fire, but has become more and more popular.

In addition to well-known LPs, the most active participants in AI are also the figures of major Internet companies. Especially for the hottest star model companies in the past year, those valuations that exceeded the US$1 billion and US$2 billion mark are the result of well-known LP and Internet companies rushing to invest. None of them wants to be left behind in this AI arms race, and none of them wants to miss the fruits of AI.

In the past year, among well-known investment institutions, Sequoia China is the most common figure that touches the AI industry and high-valued star AI companies.Although in terms of investment volume, Sequoia China invested nearly twice as few AI companies in 2024 as in 2023, in terms of investment amount, it has fully doubled.According to relevant statistics, Sequoia China’s investment in the artificial intelligence industry in 2024 will reach 2.874 billion yuan, a year-on-year increase of 111.6%; the number of investments will be 9, a year-on-year decrease of 55.6%.

This shift in investment strategy of “reducing quantity and increasing quality” reflects that the market is moving from the initial proof-of-concept stage to the commercial value realization period.

By 2024, well-known LPs led by Sequoia China will begin to shift their “wide-spread net” diversification investment in 2023 to intensive investment focusing on head projects in 2024, and the market will also show a clear Matthew effect.

In this increasingly heated AI arms race, representatives of China technology giants represented by BAT have significantly differentiated their investment strategies.

In fact, Alibaba and Tencent have similar investment strategies. Both aim to get a share of high-valued star AI companies, and also aim to expand their own ecological alliances.

It can be seen that Tencent has significantly narrowed its investment landscape in the past year, but all the companies it invests in are star AI companies.

Tencent’s investment landscape in the field of artificial intelligence in 2024, source: IT Orange

Tencent’s investment landscape in the field of artificial intelligence in 2023, source: IT Orange

Similarly, in 2024, Alibaba’s investment landscape will be similar.

Alibaba’s investment map in the field of artificial intelligence in 2024, source: IT Orange

Different from the above two, Baidu’s investment landscape in 2024 is slightly different. It has not invested in any star AI company. But its goal is also clearer, betting on industrial intelligence and commercialization of the All in big model.

Baidu’s investment landscape in the field of artificial intelligence in 2024, source: IT Orange

Compared with 2023, Baidu has significantly expanded its ammunition arsenal.

Baidu’s investment landscape in the field of artificial intelligence in 2023, source: IT Orange

In 2025, China’s AI industry has entered a new stage of “giant-led innovation.”

For entrepreneurs, they either look for ecological niche in segmented scenarios or choose to become a key module in the giant’s technology landscape.

2. Increase by 300 billion yuan,The six big models are completely divided

Surging by 300 billion yuan, the amount of financing in the AI field in 2024 will hit a ten-year high.

According to IT Orange, the amount of financing in the AI field in 2024 will reach 661.9 billion yuan, a year-on-year increase of 101.9%; and the amount of investment is almost the same as the previous year. It can be seen that the amount of single financing in the AI field in the past year was very considerable.

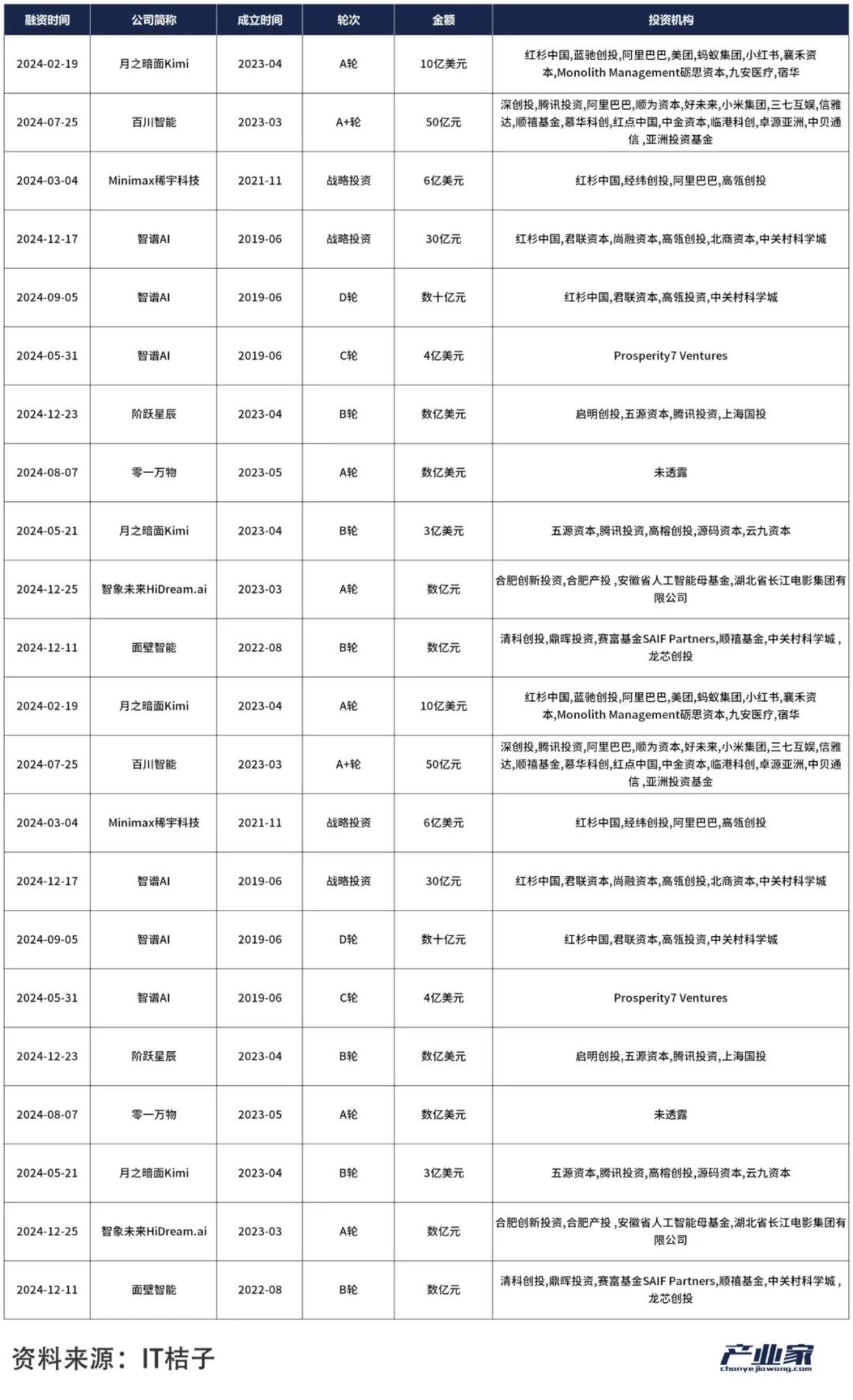

Among them, several star AI model companies with valuations exceeding the US$2 billion mark have also been born.These companies are several streets behind other AI companies in terms of valuation alone. Judging from the amount of a single financing, the “Six Little Dragons” accounted for six seats in the TOP10 financing incidents, and the amount of money absorbed by leading companies accounted for more than 60% of the industry’s total. Among them, Dark Side of the Moon and Intelligent AI have completed multiple rounds of financing in the past year, and the latter has reached Series D.

202Top 11 AI model financing events in 4 years (ranked by financing amount)

Normally, after completing Series B financing, companies have a relatively clear understanding and planning of their own strategic layout and roadmap. Judging from the above financing rounds, among the six big models, Dark Side of the Moon, MiniMax, and Step Star have all completed Series B financing, and Intelligent Intelligence AI has completed Series D financing.

However, the failure of Scaling Law, the bottleneck of computing power, and the acceleration of commercialization of large models, and some changes in the large model industry in 2024 will completely divide the six little dragons. In addition, in early 2025, DeepSeek subverted industry perceptions with “open source + minimalist architecture.” Its daily active users exceeded 20 million in 20 days, forcing OpenAI to accelerate product iteration.

The emergence of DeepSeek not only accelerated the process of AGI, but also rewritten the narrative of the entire big model industry. So far, one of the most significant changes is that large models that once insisted on closed source have begun to actively embrace open source, except for the dark side of the moon, which has not yet expressed its position on whether to open source.

Other signals about the big model six dragons are: 1) At the end of 2024, Alibaba Cloud acquired the Zero Everything team to strengthen infrastructure;2) In early 2025, Wei Wei, vice president of MiniMax, resigned, and was previously mainly responsible for the company’s ToB commercialization business.

In addition, it is worth mentioning that according to foreign media The Information, DeepSeek (Chinese name: Deep Quest), a big model rookie who has always claimed to have no financing plans,Financing has been considered for the first time in recent days, including Alibaba and Stateowned Assets, which have expressed interest in providing funds. Previously, Baidu and Zhu Xiaohu, who has never been optimistic about AGI, also said that as long as DeepSeek opens up financing, they will definitely follow.

3. The scale of AI basic level financing fell precipitously,The application layer is rapidly emerging

A profound restructuring of the capital structure is taking place.

Card lack has been a key word in the past two years. But in the primary market, investors do not seem to show much confidence. On the one hand, due to high technical barriers, AI chip companies themselves have great problems; on the other hand, the capital-level return cycle is lengthened, and the average profit cycle of AI chip companies is extended to 8-10 years, far exceeding the duration of VC funds.

According to industry statistics, AI basic level financing incidents have dropped sharply from 104 in 2023 to 70 in 2024, a drop of 32.7%; the peak value of single financing has shrunk from 2 billion yuan (Suiyuan Technology Series D) to 500 million yuan (Wuwen Xinqiong Series A), capital intensity has shrunk by 75%.

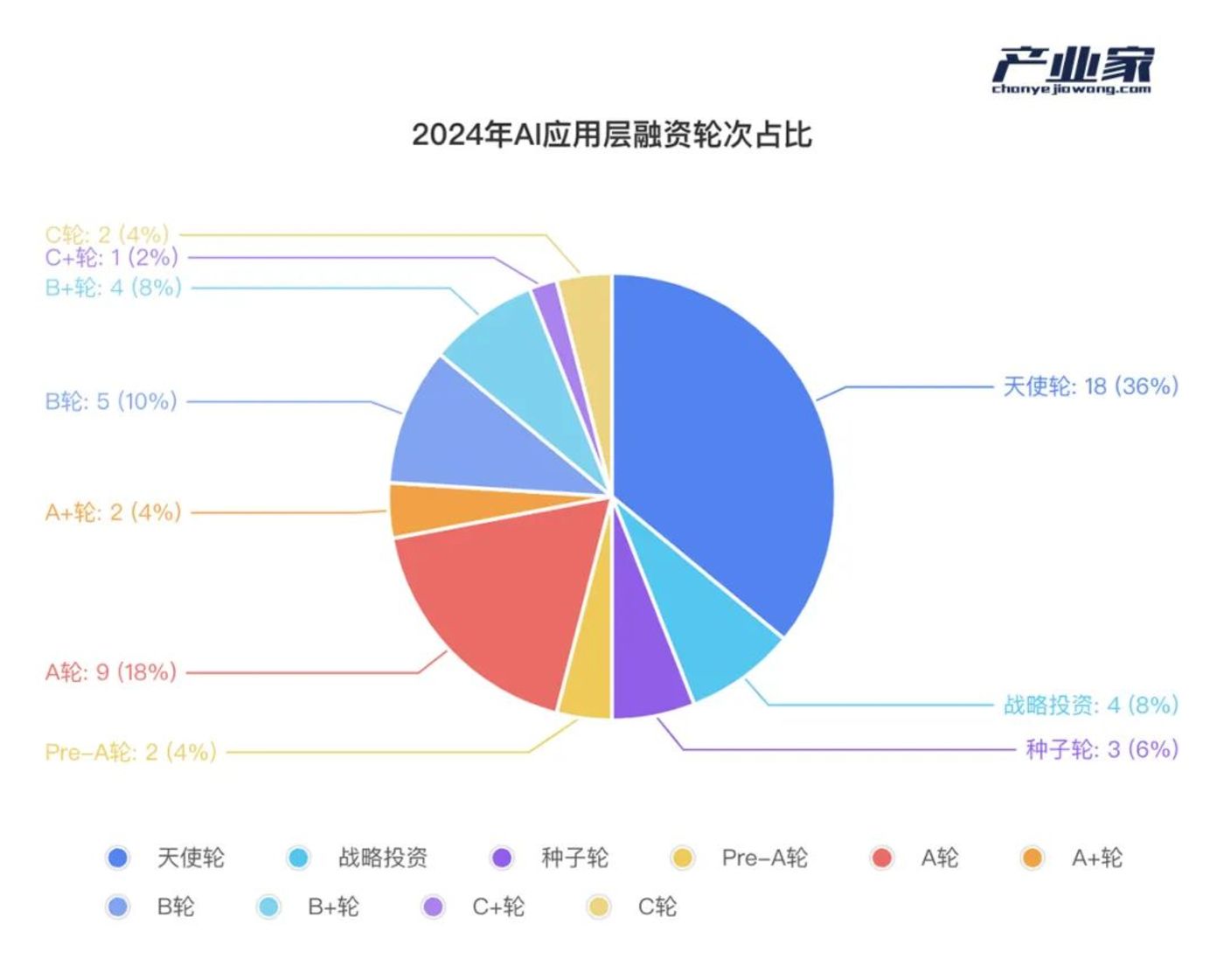

However, unlike the basic layer, investors are more optimistic about the upper application layer. According to statistics, among the financing incidents at the AI application level in 2024, newly established companies accounted for nearly 50%, and 36% of financing incidents were concentrated in Angel rounds. There are obvious signs of capital rushing to early projects.

The reason is not difficult to understand. For AI, an industry that stands at the forefront, both investors and entrepreneurs want a piece of it. Areas such as the AI application layer that are easier to commercialize and relatively less difficult are the easiest entry points.

However, when the time comes to 2025, the AI basic layer and AI application layer may usher in a capital restructuring.

As the MaaS model matures,The boundary between the basic layer and the application layer will gradually melt away. Application companies with independent computing power clusters (such as the Dark Side of the Moon) and infrastructure providers with scenario implementation capabilities (such as Huawei Shengteng) may restructure the industrial value distribution pattern.

4. Robots + intelligent driving account for half of the total,What exactly is capital betting on?

In 2024, in addition to the continuing hot big models, almost all of the other two hot spots will focus on autonomous driving and embodied intelligence. Of course, capital will not miss this opportunity.

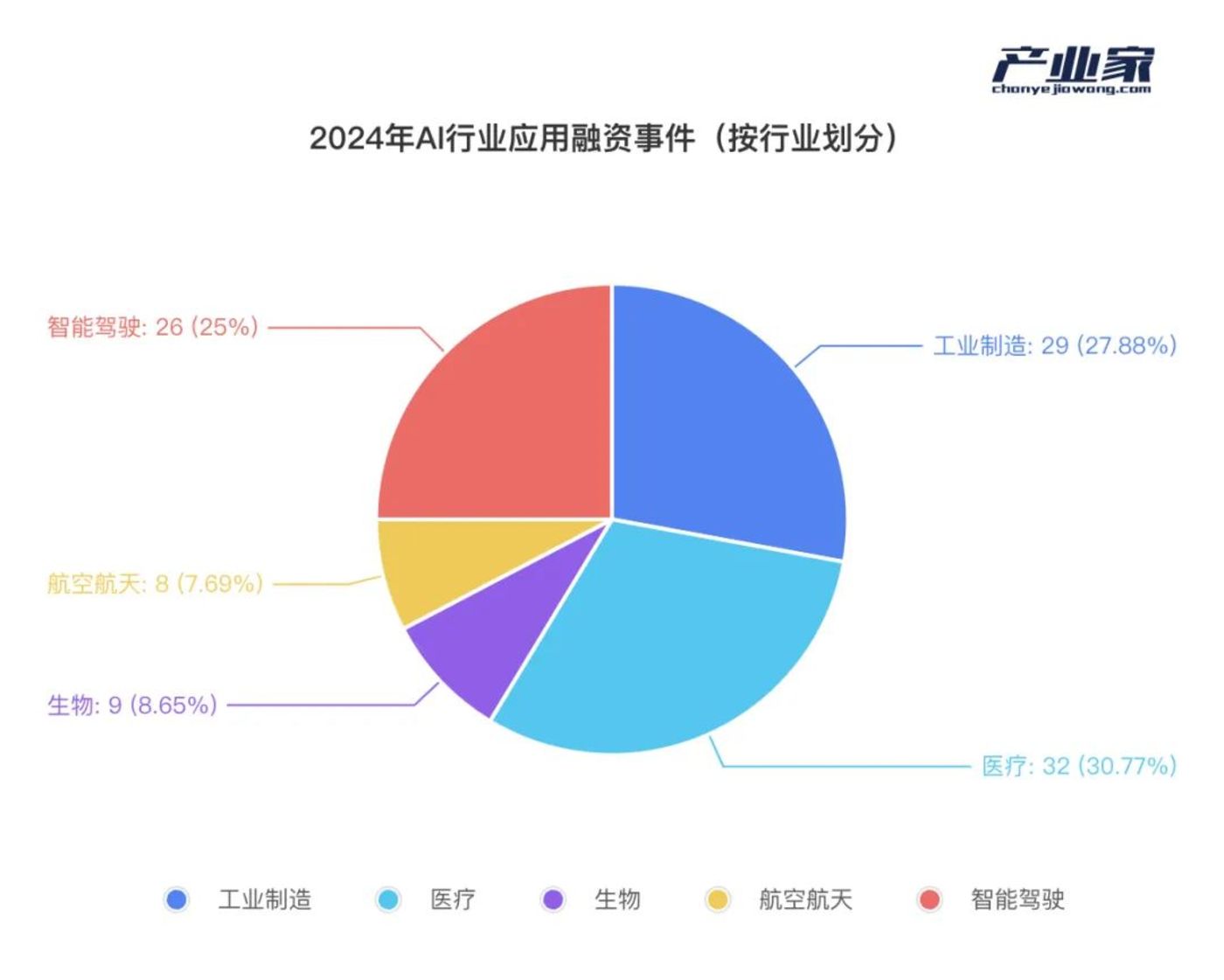

According to IT Orange, there will be 209 application financing incidents in the AI industry in 2024, accounting for 41.22%, and the proportion is almost the same as last year. According to industry statistics, among the AI industry application financing incidents in 2024, capital is mainly concentrated in five major industries, namely industrial manufacturing, medical care, intelligent driving, biology and aerospace. Among them, the vast majority of robots are classified as industrial manufacturing, while autonomous driving and driverless driving are also classified as intelligent driving.

Autonomous driving has been ups and downs for many years, but this time it finally comes with an opportunity. The market trend of autonomous driving will continue to heat up in 2024.

On October 24, Horizon was officially listed on the Hong Kong Stock Exchange;

On October 25, Wenyuan Zhixing was listed on Nasdaq;

On November 7, Sidi Zhijia submitted a listing application to the Hong Kong Stock Exchange;

On November 27, Xiaoma Zhixing was listed on NASDAQ.

According to incomplete statistics from the 21st Century Business Herald, since 2024, a total of 14 China autonomous driving related companies have been listed on major exchanges or promoted the listing process. However, judging from the specific industry distribution, in the smart driving category, L2 track assisted driving is still the first choice for capital.

The wave of autonomous driving listings is not over yet, and it is followed by a craze for specific smart financing. For example, Yushu Technology, which appeared on the stage of the Spring Festival Gala, also completed two rounds of financing last year and has completed Series C. As of now, it has a valuation of 10 billion yuan; another example is the Zhiyuan Robot, which is particularly popular, which has been established since early 2023. In the year, six rounds of financing have been completed in succession. The investors include Baidu, BYD, and Hillhouse Ventures. As of now, the valuation has reached 7 billion yuan.

From the perspective of valuation, embodied intelligence is as popular as the six big models.

But in fact, whether it is driverless driving or embodied intelligence, neither is a new concept. The listed boom and financing boom seen above are only the tip of the iceberg.Under the iceberg, what is truly favored by capital is still the specific applications rooted in vertical industries. However, the rise of AI models has allowed capital to see their commercial value again.

Therefore, whether it is robots or intelligent driving, what capital pursues is never a certain concept, but a genuine return on income.

Write at the end:

Overall, 2024 is a year for large models to be eager to commercialize. At the end of 2024, some signals have already emerged, but in early 2025, the emergence of DeepSeek disrupted all narratives about AI.

DeepSeek attracted a tsunami.

Jobs once said that innovation is not about creating completely new products. Standing in the current context, DeepSeek’s innovation lies in using new technology to solve the card shortage problem that has plagued domestic AI companies for two years. Since then, domestic AI manufacturers have actively embraced open source and even actively opened up product boundaries.

A year ago, Zhu Xiaohu once expressed that he did not believe in AGI.But today, a year later, Zhu Xiaohu made another statement. DeepSeek is almost making me believe in AGI.” rdquo; In the AI era, China’s new entrepreneurial story is coming back to the capital stage.