The rise of cryptocurrencies is not just a wave of technology, but also a profound rebellion against “legal violence” currency plunder.

Written by: Daii

This weekend, the North Korean hacker group Lazarus Group hit the screen again. Because this time they did a big job and stole nearly $1.5 billion in Ethereum from the Bybit exchange. This was the largest theft in the history of encryption and had a big impact on the market. The price of ETH fell from around 2850 and almost fell below 2600.

The principle of this North Korean hacking attack is not complicated. It still uses social engineering to trick relevant personnel into executing malicious programs. At the end of last year, I was in “Is the Cold Wallet Cold? “How a senior journalist was cheated of $400,000” has a detailed analysis of its deception process. It also contains many tips for ordinary users to prevent fraud. I recommend you to take a look when you have time.

In fact, I think there is one more thing that deserves your attention. That is, Nigeria claimed US$81.5 billion from Binance, including US$2 billion in taxes and US$79.5 billion in compensation.

Because hacking theft is a crime, and there is nothing to say about it. We just need to work together to catch the bad guys and minimize losses. However, the merits of Nigeria’s claim of 79.5 billion yuan are less obvious.

Have you noticed that these two cases have one thing in common, and both have the shadow of the country behind them? Cryptocurrency is becoming a new battlefield in the national game, and the intervention of national power has made this process more complex and challenging.

So, what did Binance do to compensate so much to Nigeria?

What Binance does is to provide people in Nigeria with a P2P platform for fiat to purchase cryptocurrencies, allowing people in Nigeria to exchange Naira (NGN) into bitcoin or U.S. dollar stablecoins when the currency devaluates.

Of course, I don’t have much favorable feelings for Binan. It has done a lot of work in inserting pins and targeted blasting.

The reason why I came out to say a few words for Binan today is that one of the core values of the centralized exchange to the blockchain is to provide a safe and convenient channel from fiat to cryptocurrency.

If Nigeria succeeds this time, then many more rogue countries will follow suit. In the future, no one even stole it, and instead robbed it directly. By then, rogue states ‘cross-border secret arrest of centralized exchange executives will become a business, and the entire blockchain ecosystem will be harmed. This is not alarmist, it is a fact that has already happened. All this stems from the fact that today, the state is the only entity that can have legal violence.

Okay, let’s first understand what happened between Nigeria and Binance.

1. Does Binance cause Naira to devalue?

On February 19, 2025, the Federal Revenue Service (FIRS) of Nigeria filed a lawsuit in the court, demanding Binance, the world’s largest cryptocurrency exchange, to pay US$79.5 billion in economic compensation and US$2 billion in taxes, citing the fact that Binance’s “illegal operations” caused the country’s currency, Naira, to depreciate by 70% and triggered severe inflation.

Nigeria’s accusation seems “logically clear”: the naira transactions on the Binanping Platform are huge, and users use its P2P market to exchange their local currencies for encrypted dollars (such as USDT) or Bitcoin, causing a surge in foreign exchange demand and the collapse of the naira exchange rate. In 2023, Nigeria’s central bank claimed that US$26 billion was illegally flowed out through Binance, while the country’s inflation rate soared to 33.88% in 2024.

But the truth behind the data is more complex.

Binance is indeed a technical “accomplice”: its platform provides people with a convenient tool to circumvent foreign exchange controls. Against the background of the devaluation of the naira and the shortage of the dollar, cryptocurrency has become a new “safe-haven asset”. In the past, it relied on underground banks to exchange for dollars, but now it can be completed with just a mobile phone. In March 2024, Binance was forced to shut down the Naira trading service, but by this time Naira had fallen to an all-time low, with 1605 NGN per US dollar.

First of all, we should rule out that Binan is not the “murderer” of the Naira collapse.

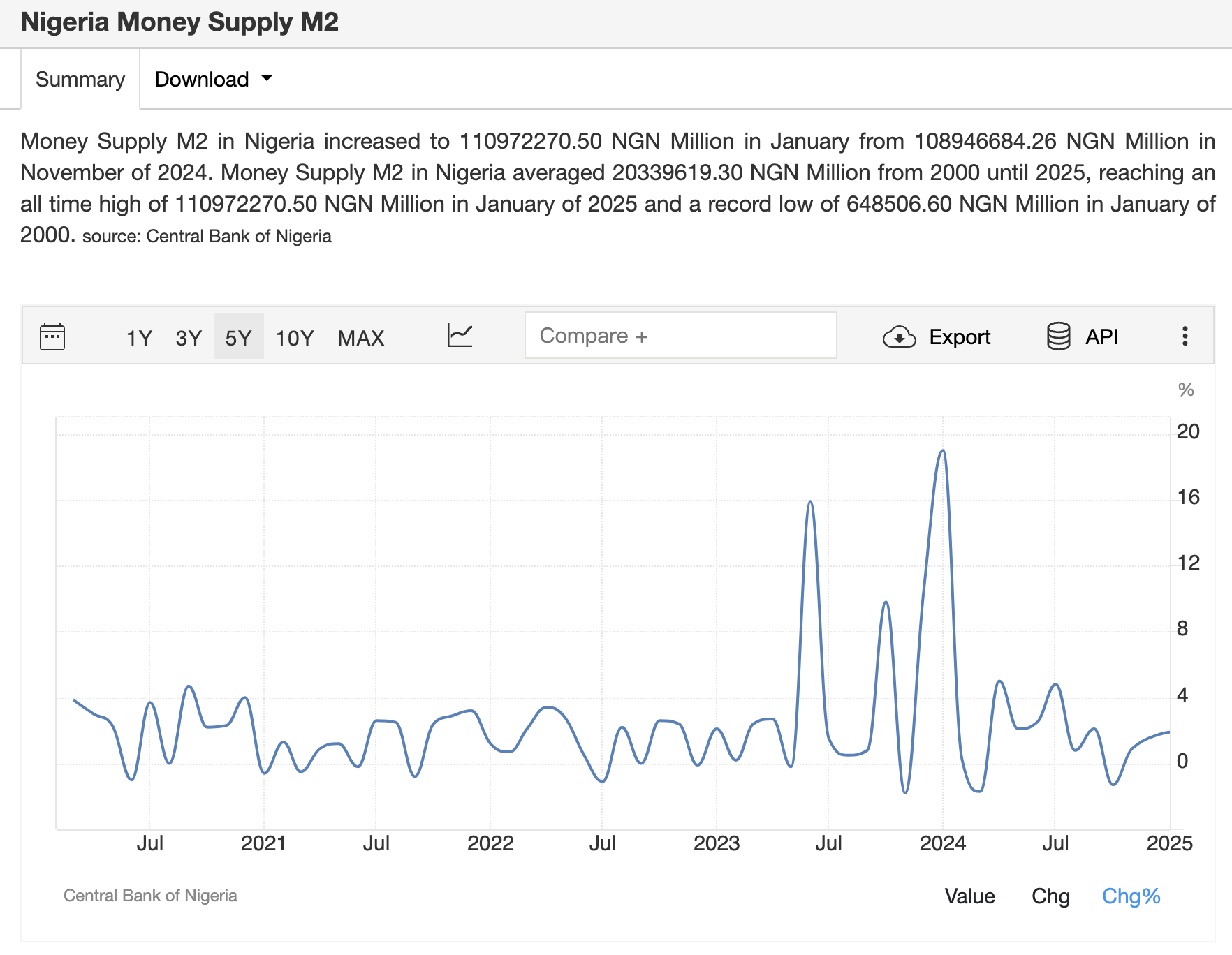

Because, after Binance left, the exchange rate briefly rose to 1100 NGN to 1 US dollar in mid-April 2024 (see figure above). However, you find that the exchange rate has dropped to near an all-time low again, and is now around 1500 NGN to 1 US dollar.

Therefore, without Binan, the Naira exchange rate would still fall so miserably. As for the reasons, we will discuss them in detail later. But at least for now, it can be clear that Binan is not the “real murderer.”

So, who did it?

2. Who is the real culprit of the currency crisis?

The real murderer is Nigeria itself. There are three main problems:

M2 money supply surges: Since 2019, Nigeria’s M2 growth has exceeded 17%, far exceeding GDP growth, directly pushing up inflation.

Oil dependence and foreign exchange shortage: The country relies on oil exports for 80% of its foreign exchange earnings, but production capacity is unstable, resulting in the depletion of US dollar reserves and the rise in the price of imported food.

Policy mistake: In 2023, President Tinubu relaxed foreign exchange controls in an attempt to attract foreign investment, but caused the naira exchange rate to fall in free fall.

Please note: In Nigeria, currency devaluation and inflation occur simultaneously, and are mutually reinforcing and cause and effect, forming a strong positive feedback.

What is positive feedback?

For a simple example, you point the microphone at the speaker and shout, and you will hear a scream. This is the simplest positive feedback in reality.

Specific to the case of Nigeria, the positive feedback process between currency devaluation and inflation is as follows.

With the devaluation of the naira, the prices of imported goods soared, leading to a sharp rise in the domestic price level. High prices in turn led to an increase in the cost of living for the people, thus further exacerbating inflation.

In order to prevent the naira in their hands from devaluing, ordinary people have exchanged naira for cryptocurrency (bitcoin or U.S. dollar stablecoin) through P2P platforms such as Binance, thus further promoting the substantial devaluation of naira.

According to data from the National Bureau of Statistics of Nigeria, the relationship between naira devaluation and inflation is particularly strong in 2023. For example, annual inflation in Nigeria will reach 32.85% in 2023, while food prices will rise by more than 40%.

However, the good news is that Nigeria’s inflation rate is rising from a peak of 34.8% since 2025 to currently around 24%(see chart above).

However, you should know that 24% inflation is also a relatively high level. If Nigeria cannot solve this problem, it will become another Venezuela.

By comparing the economic woes of Nigeria and Venezuela, you will find many striking similarities.

Venezuela has experienced severe currency devaluation and ultra-high inflation since 2010, which eventually led to the almost disappearance of the purchasing power of the country’s currency, the bolivar.

According to data from the International Monetary Fund (IMF), Venezuela’s inflation rate will still be as high as above 3000% in 2023. Soaring prices have plunged people into poverty, and currency devaluation has forced many people to convert bolivar into foreign currencies, especially U.S. dollars and Bitcoin. In fact, the circulation rate of cryptocurrencies in Venezuela is extremely high, making it the only way for many people to avoid inflation risks. In 2023, Venezuela ranks among the top in the world in terms of cryptocurrency trading volume, especially on P2P trading platforms, where people use Bitcoin and stablecoins for daily transactions.

If Nigeria cannot effectively solve the fundamental problems of its currency devaluation and high inflation, like Venezuela, Naira may also move towards the path of “Bolivization,” that is, becoming a currency with no real purchasing power and completely unable to support people’s daily life.

In the end, people will choose to abandon their national currency, naira, and use cryptocurrencies instead. But in those days when there were no cryptocurrencies, did you know how national currencies did whatever they wanted?

3. How does a country plunder people through currency?

In short, backed by legal violence, we act recklessly.

On the Pacific Island of Yap, primitive tribes used a two-meter diameter limestone disc as currency. These “stone coins” weighing several tons do not need to be moved, and only need to change ownership records during transactions. This may be the earliest prototype of blockchain. When the Spanish colonists used explosives to carve the cross on stone coins, they inadvertently interpreted the most ironic fable in the history of money: the authority of money always comes from violent endorsement.

From the debt certificates recorded by the Sumerians on clay plates to the bronze coinage of the Shang and Zhou Dynasties, it took 5,000 years for humans to alienate money from a measure of value into a tool of governance. After the collapse of the Bretton Woods system in 1971, the US dollar was decoupled from gold, and the world officially entered the “era of fiat currency carnival.”

3.1 Inflation: The wealth transfer technique of boiling frogs in warm water

The scene of housewives pushing wheelbarrows to transport banknotes to buy bread during the Weimar Republic has evolved into a more covert method of plunder in modern society. According to IMF data, the global average inflation rate in 2023 will be 6.9%. Behind the seemingly moderate figure is the 51-year escape of purchasing power under the US dollar system. In 1971, the gold content of 1 US dollar was equivalent to 0.02 grams now, a contraction of 98%.

-

Inflation is essentially a phenomenon in which the money supply exceeds the demand for economic growth, resulting in a decline in the purchasing power of money. When the government or central bank overissues money, the newly printed money does not increase the total wealth of society, but only dilutes the value of the original money. The process of wealth transfer is hidden and slow:

-

Excess currency: The government or central bank increases money supply through quantitative easing, monetization of fiscal deficits and other means.

-

Rising prices: Too much money chases limited goods and services, leading to a general rise in prices. Initially, price increases may start in certain areas and gradually spread to various areas.

-

Purchasing power declines: As prices rise, people hold fewer goods and services that can purchase with money, and purchasing power declines. Fixed income earners (such as retirees, low-income groups) are hardest hit because their income growth tends to lag behind inflation.

-

Wealth transfer: Inflation actually transfers wealth from currency holders (especially savers) to debtors (such as governments, indebted companies) and those who first receive new money. The government can reduce its debt burden through inflation, and those who can obtain new money more quickly (e.g., companies and financial institutions with close ties to the government) can take advantage of the opportunity that prices have not yet risen fully in the early stages of inflation to buy assets or commodities at lower prices to make a profit.

3.2 Three paths to wealth robbery

The state, as the designer and controller of the modern monetary system, is like a brilliant alchemist. It can transform seemingly invisible money into real social wealth, and in the process, quietly complete the “plunder” of national wealth. This kind of plunder is not carried out openly, but transfers wealth in the name of “legality.” Its exquisite method and far-reaching influence deserve our in-depth analysis. Next, we will focus on how the country quietly completes the “plunder” of people’s wealth through three main monetary means.

1. Seigniorage: The Most Elegant Robbery

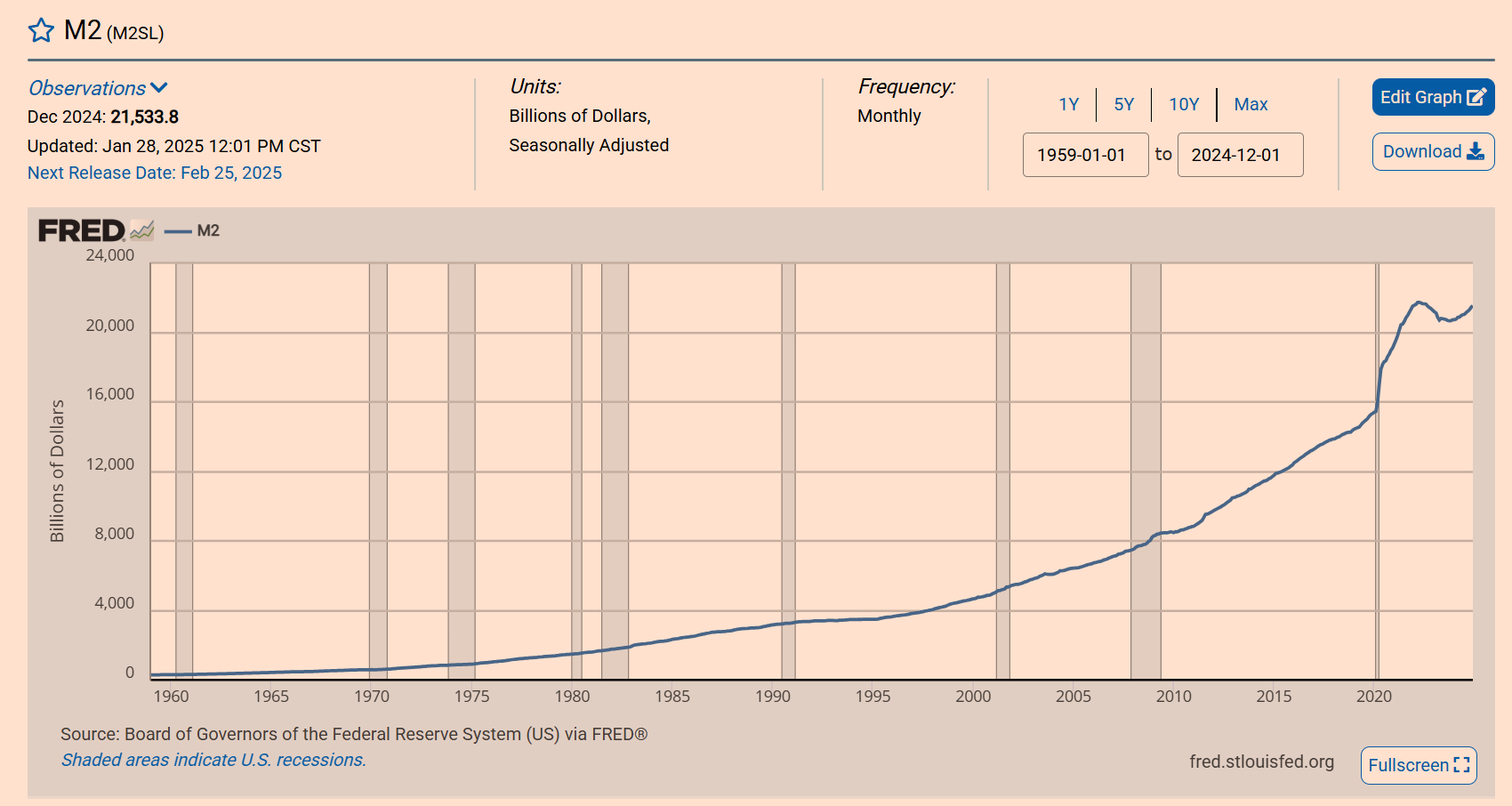

When the Federal Reserve creates US$1 trillion out of thin air to buy treasury bonds, it is equivalent to imposing an implicit tax of 4.8% on global dollar holders (calculated based on the U.S. M2 money supply of 20.8 trillion in 2024). When Sri Lanka’s foreign exchange reserves were exhausted in 2022, the government directly froze people’s dollar accounts, and the exchange difference between forced foreign exchange settlement reached 40%. This is the most naked form of currency plunder.

Seigniorage originally referred to the income from government-issued currency. In the gold standard era, it was the difference between the face value of a currency and the cost of minting. Under the modern legal tender system, the concept of seigniorage has been expanded to refer to the government’s behavior of issuing money to increase the money supply, thereby diluting the value of existing money and transferring social wealth. The mechanism is similar to inflation, but more focused on the government’s role as the issuer of the currency:

Government issues currency: The central bank, acting as an agent for the government, issues new currency. Under the modern electronic money system, issuing money is more an accounting operation than the actual printing of banknotes.

Purchase assets or make up for fiscal deficits: The government uses newly issued currency to purchase assets such as treasury bonds and foreign exchange, or directly use it to make up for fiscal deficits and stimulate the economy.

Inflation effect: The increase in money supply will eventually reduce the purchasing power of existing money in the form of inflation.

Transfer of wealth: The essence of seigniorage is still the transfer of wealth, from all currency holders to the government. The government earns income by issuing money, while the purchasing power of the public is diluted. Compared with traditional taxes, seigniorage is more subtle and difficult to detect, so it is also called “the most elegant robbery.”

2. Capital control: the cage drawn by the golden staff

From the end of 2023 to the beginning of 2024, the Argentine government further tightened capital controls in response to the ongoing economic crisis and hyperinflation. The amount of dollars individuals can purchase through official channels per month is strictly limited to $200. Strict control policies have directly led to the rampant black market. The black market exchange rate of the “blue dollar” continues to soar, even exceeding the official exchange rate by more than 100% at the end of 2023. Capital control, the “golden stick”, ultimately traps not only capital, but also people’s economic freedom.

Capital controls refer to government measures to restrict the cross-border flow of funds. Common means include restricting foreign exchange transactions, restricting capital remittance, and compulsory foreign exchange settlement. Capital controls may be regarded by the government as a necessary means to stabilize the economy and prevent capital flight at a certain period of time, but in the long run, they often distort the market and cause wealth transfer:

Artificial exchange rate differences: Capital controls artificially separate the official exchange rate from the market exchange rate, resulting in a situation where the official exchange rate is artificially low, while the black market exchange rate reflects the true supply-demand relationship. This exchange rate difference is the core mechanism of wealth transfer.

Compulsory or disguised forced settlement of foreign exchange: The government may force exporting enterprises to sell foreign exchange earnings to the central bank at the official exchange rate, or use other means to forcibly settle foreign exchange in disguised form. As the official exchange rate is undervalued, the real income of exporting companies has shrunk and wealth has been transferred to the government.

Rent-seeking space and corruption: Capital controls create huge rent-seeking space. Individuals and businesses that can obtain foreign exchange at official exchange rates, or can break capital controls and transfer funds out of the country, often reap huge benefits. This kind of rent-seeking behavior can easily breed corruption and lead to the concentration of social wealth among a few privileged classes.

People’s wealth shrinks: For ordinary people, capital controls restrict their freedom to hold foreign currency and invest overseas. If the currency depreciates, their savings face the risk of shrinking. At the same time, due to the high black market exchange rate, if people need to buy foreign exchange (for example, study abroad, travel, and purchase imported goods), they have to pay higher costs, and their wealth is plundered in disguise.

3. Monetization of Debt: The Deed of Sale for Future Generations

Japan’s national debt has reached 217.4% of GDP, equivalent to US$73,000 in debt for every newborn born. The U.S. government pays US$2.38 billion in interest on national debt every day, and these figures will eventually be passed on to taxpayers through inflation. As cryptocurrencies begin to swallow up Treasury bond buyers, the overseas holdings of U.S. bonds in 2023 have dropped to a historical freezing point of 30%.

Debt monetization refers to the government’s direct or indirect conversion of part of national debt into money, usually through the central bank’s purchase of national debt. In extreme cases, the government may directly instruct the central bank to print money to purchase treasury bonds to make up for fiscal deficits. Debt monetization may relieve the government’s fiscal pressure in the short term, but in the long run, it will bring serious risks:

The government’s fiscal deficit widens: Monetization of debt easily makes the government financially dependent and relies too much on printing money to make up for the deficit, rather than adopting responsible fiscal policies to control expenditures and increase revenue.

Damage to central bank independence: Direct government intervention in currency issuance will damage the central bank’s independence and turn the central bank into the government’s “money printing machine” and cannot effectively control inflation.

Hyperinflation risk: Long-term, large-scale debt monetization will inevitably lead to the loss of control of the money supply and trigger hyperinflation. Historically, the Weimar Republic, Zimbabwe, etc. have all experienced hyperinflation due to excessive debt monetization, resulting in the collapse of the monetary system and chaos in social and economic order.

Wealth looting: Hyperinflation is the most brutal looting of social wealth. The value of all savings and assets denominated in local currency will be greatly reduced, social wealth will be redistributed, and the government debt burden will be reduced, but people’s wealth will suffer huge losses. Debt monetization actually transfers current fiscal risks to future society and uses future inflation to pay for today’s debt.

From the “elegance” of seigniorage, to the “cage” of capital control, to the “deed of servitude” of debt monetization, the way the state uses monetary means to plunder people’s wealth can be said to be “full of tricks and impossible to prevent.” These “legal” plundering is often disguised as maintaining economic stability, responding to crises, and stimulating growth. In fact, it is quietly transferring social wealth and eroding people’s economic freedom.

3.3 The price of wealth robbery

The country plunders people’s wealth through monetary means. The impact goes far beyond the economic level, but also penetrates into many dimensions such as society, politics, culture, etc., causing far-reaching and negative impacts:

Social level:

The gap between rich and poor widens: Currency plunder often makes the rich richer and the poor poorer, exacerbating the polarization between rich and poor in society. Privileged classes and vested interests are more likely to profit from currency plunder, while ordinary people, especially vulnerable groups, become the main victims.

Increased social injustice: Hidden methods of currency plunder, such as inflation, are often not easily detected, but the transfer of wealth they cause is real, which will aggravate the sense of social injustice and trigger social conflicts and conflicts.

Disintegration of social trust: When people realize that the government plunders wealth through monetary means, their trust in the government, the central bank and the entire social and economic system will be shaken or even completely disintegrated, resulting in a decline in social cohesion.

Political level:

Government credibility declines: currency plunder, no matter how “legal”, is essentially a violation of people’s wealth. The government’s long-term reliance on this means will inevitably lead to a decline in credibility and doubts about the legitimacy of governance.

Authoritarian tendencies: In order to maintain rule and cover up the truth about currency plunder, governments may strengthen information controls, suppress dissent, or even move towards authoritarianism.

Risk of political turmoil: Long-term economic hardship and social injustice may eventually lead to political turmoil and social change. Historically, hyperinflation has often been an important cause of social unrest and regime change.

Cultural aspects:

Distorted values: When society generally realizes that honest work cannot get rich, but only by taking advantage of opportunity and relying on power can profit, society’s values will be distorted and the traditional virtue of hard work will be continuously eroded.

Cynicism is prevalent: Faced with irresistible currency plunder, people may feel powerless and hopeless, turn to cynicism, be indifferent to social and political issues, and even ridicule all sublimity and ideals.

National identity crisis: Long-term economic difficulties and social injustice may lead to a decline in national identity, the disintegration of national cohesion, and even social division and national disintegration.

Obviously, in the process of currency plundering people’s wealth, there is a sharp opposition between national monetary sovereignty and people’s property rights. At this time, it is time for national violence to take effect.

4. State violence endorses currency plunder

“When a gun rings, thousands of taels of gold.”

The essence of state violence is to maintain order and the ultimate arbiter of wealth. When countries encounter challenges through “legal” plunder of money, state violence often comes to the forefront without hesitation to protect the plunder of money.

The Nigeria government did the same.

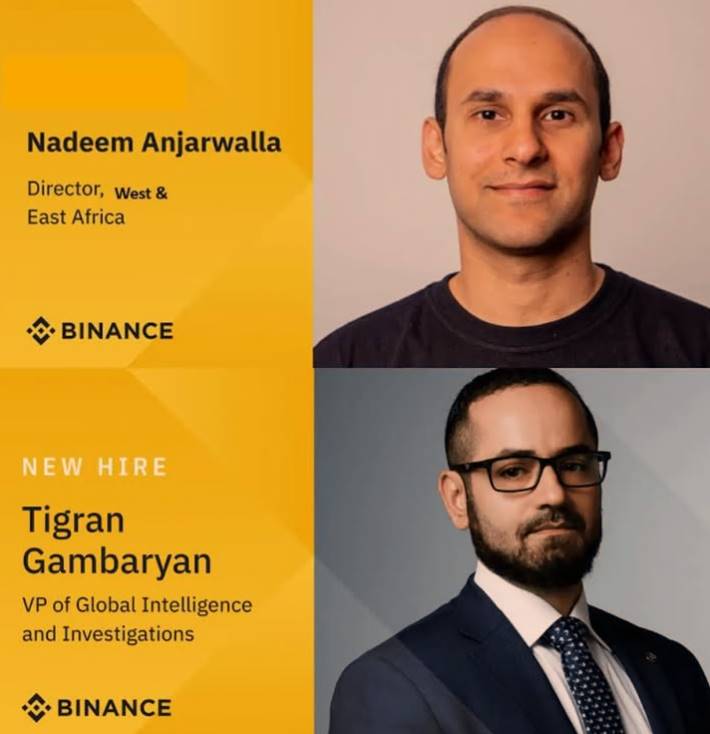

Previously, two Binance executives, Tigran Gambaryan, a US citizen, and Nadeem Anjarwalla, a British national, were invited by the Nigeria government to go to the country to negotiate issues related to cryptocurrency transactions. However, what awaits them is not the negotiating table, but a carefully woven web by Nigeria. The government detained two senior executives for a long time on charges of “illegal operation” and “causing the devaluation of Naira.”

Although Nadeem Anjarwalla risked escaping from prison, Tigran Gambaryan was detained by Nigeria for nearly seven months. During this period, he suffered from malaria. The prison medical conditions were in vain, and his life and health were in jeopardy. In the end, the U.S. government had to personally step down and exert strong diplomatic pressure before forcing Nigeria to release the prisoners.

The state’s violent machine’s endorsement of currency plunder is by no means a “monopoly” of Nigeria, but a common phenomenon throughout currency history. In order to maintain the dominant position of the fiat tender system and protect the state’s monopoly power over currency, governments of all countries have not hesitated to use state violence machines.

Far away, gold in the United States is “nationalized”.

In 1933, in response to the Great Depression and the gold standard crisis, U.S. President Roosevelt signed “Executive Order 6102”, forcing U.S. citizens to hand over their gold to the government at extremely low prices in the name of “treason.” Those who refused to obey will face heavy penalties and huge fines. The U.S. government used this to “legally” confiscate the people’s gold wealth, clearing the way for the government to overissue money and implement Keynesian policies. The Roosevelt administration used the national violence machine to enforce monetary policy, laying the foundation for future dollar hegemony.

Recently, Venezuela’s “Bolívar push”.

Venezuela has long been mired in hyperinflation, and its currency, the Bolivar, has almost collapsed. Faced with the “dollarization” trend of people spontaneously using foreign currencies such as the US dollar to protect themselves, the Venezuelan government not only did not reflect on its own monetary policy mistakes, but instead intensified its use of the national violence machine to vigorously promote “Bolivarian sovereignty” and suppress the circulation of foreign currencies.

The Venezuelan government has dispatched troops and police to crack down on “illegal foreign exchange transactions” across the country, arresting people and businesses who exchange dollars on the streets, and confiscating “illegally” dollars. Even the Venezuelan government forces companies and merchants to accept Bolivar payments, refuses to accept foreign currencies such as U.S. dollars, and imposes heavy penalties on those who refuse to enforce, or even revokes business licenses. The Venezuelan government has used state violence not to rebuild a healthy monetary system, but to maintain its rule over the already discredited Bolívar and continue to plunder national wealth through hyperinflation and forced foreign exchange settlement.

What’s even bloodier is the Argentine “Corralito”

In 2001, a serious financial crisis broke out in Argentina. In order to prevent bank runs and capital flight, the government resorted to the “Corralito” policy, forcibly freezing bank accounts and restricting people from withdrawing deposits. This policy directly deprives people of their freedom to save, allowing their wealth to be “legally” locked in banks and allowed to be slaughtered by the government.

The “fence” policy triggered Argentine society. Angry people took to the streets, beating pots and pans, demanding that the government lift the “fence” and return their deposits.

However, the Argentine government not only refused to respond to the people’s demands, but instead used police and security forces to brutally suppress the protests. In December 2001, Argentina entered a state of emergency. Violent clashes broke out between military police and protesters, resulting in dozens of deaths and hundreds of injuries.

Obviously, every appearance of state violence reminds us of an undeniable fact, that is, people’s property rights are vulnerable to a single blow in the face of national monetary sovereignty.

However, the story is far from over here. Under the Iron Curtain where state violence repeatedly endorses currency plunder, a ray of light is penetrating the darkness, that is, the rise of cryptocurrencies.

5. Cryptocurrency: The era of regaining the initiative in wealth

The rise of cryptocurrencies is like a “Sword of Damocles” hanging over the government’s monetary power, threatening those state machines that arbitrarily manipulate fiat currencies. It is not just a payment tool, but a profound challenge to the global monetary system, giving people around the world an unprecedented weapon to regain control of their wealth and freedom.

You may ask, can a pure digital currency really compete with huge government power?

The answer is yes: not only can cryptocurrency resist a centralized financial system, it is inherently designed to become a key tool in fighting state violence.

5.1 The power of decentralization: reshaping wealth control

The birth of Bitcoin is a profound question of the global financial order.

In 2008, as the global financial crisis swept through, Satoshi Nakamoto created Bitcoin. This new type of currency no longer relies on the central bank or any government agency for issuance and supervision. Its supply is fixed, transaction records cannot be tampered with, and all transactions are jointly verified and confirmed through decentralized nodes around the world.

The decentralized nature of Bitcoin makes it a powerful weapon against government monetary violence. Especially in countries where people’s wealth has been severely plundered due to corruption, indiscriminate currency issuance or financial oppression, cryptocurrencies provide a safe haven. For example, in 2018, after the Argentine government implemented a cash control policy, people turned to cryptocurrencies such as Bitcoin to circumvent the government’s currency intervention. According to Blockchain.com, Bitcoin trading volume in Argentina surged by more than 200% during the period of cash controls.

This decentralized nature also makes cryptocurrencies an effective hedging tool for global inflation risks. In March 2020, central banks around the world implemented large-scale monetary easing due to the epidemic, resulting in the devaluation of the fiat currency. At the same time, Bitcoin’s return rate has soared. Data shows that since the outbreak of the epidemic, Bitcoin’s total return rate has been close to 400%, while gold is only 30%. The stock market has fluctuated greatly and has failed to effectively preserve its value. Cryptocurrencies have become the first choice for many asset hedders.

5.2 Transparency and immutability: the defense against wealth plunder

In addition to decentralization, the transparency and immutability of blockchain make cryptocurrencies another weapon in the fight against financial violence. Every transaction recorded on the blockchain can never be changed, which means that all financial flows will be publicly inspected and there will be no more opportunities for countries to engage in invisible plunder through manipulation of monetary policy.

For example, hyperinflation and the devaluation of the Bolivar in Venezuela have caused large numbers of people to choose the US dollar as an alternative. However, the government has taken coercive measures to force merchants and citizens to use only bolivar and severely suppress dollar transactions. But these measures have failed to stop more and more people from turning to cryptocurrencies, especially when the economy is in trouble. According to statistics, the volume of Bitcoin transactions in Venezuela soared by more than 100% in 2018, while the monopoly and corruption of the traditional financial system have not yet been fundamentally resolved. Through cryptocurrency, Venezuelan people have successfully circumvented government control over traditional currencies.

Cryptocurrencies provide a reliable financial freedom channel that allows Venezuelans to protect wealth and allocate assets across borders without state intervention, providing them with a way out of the domestic currency crisis.

5.3 Data and facts: Global potential for the rise of cryptocurrencies

Since the birth of Bitcoin, the market size of cryptocurrencies has grown exponentially. According to CoinGecko, the global market value of cryptocurrencies has climbed from less than US$100 billion in 2017 to US$3.29 trillion today, an increase of more than 30 times. This growth not only stems from speculative investors, but more importantly, under the global economic crisis, the devaluation of fiat currencies and financial oppression, people’s trust in cryptocurrencies has continued to increase.

Especially in countries that have experienced currency violence, such as Argentina, Venezuela and Turkey, market demand for cryptocurrencies has increased significantly. In 2018, the volume of Bitcoin transactions in Venezuela rose sharply, indicating that people lost trust in fiat currencies and turned to cryptocurrencies as a means of preserving wealth. Similarly, when the Turkish lira devalued in 2020, Bitcoin became a safe-haven asset, and trading volume rose sharply.

These data strongly demonstrate that cryptocurrencies are becoming a new choice for wealth management around the world, especially in the face of state violence and pressure from currency devaluation.

5.4 The future of cryptocurrencies: A new dawn for the global financial system

Cryptocurrency is not only a tool to counter violent monetary policies, it is also a carrier of a new wealth management concept. In a decentralized, transparent, and untamper system, individuals can have complete control of their wealth without worrying about government encroachment and plunder of their wealth. As people in more countries realize this, the application scenarios of cryptocurrency will become more and more extensive, and it will become an important part of the future global financial system.

The paradox of history is that when the government alienates the right of coinage into a tool of exploitation, the people’s original intention of eventually using technology to rebuild money is not a bargaining chip for power, but a measure of value. In this emerging era, wealth is no longer a vassal of the state apparatus, but the private property of everyone.

The global financial revolution has quietly begun driven by cryptocurrencies. Those national violence machines that once wantonly plundered wealth are facing an adversary that cannot be ignored: decentralized cryptocurrency. Bitcoin provides them with an effective way to maintain the value of wealth and conduct cross-border transactions in the context of government-imposed downward exchange rates. If you are Xiaobai and want to protect your wealth through Bitcoin, here are two zero-based tutorials. One is on how to buy Bitcoin, and the other is on how to send Bitcoin to a cold wallet. It should be enough for you.

Summary: Cryptocurrency is a challenge and change to national currency violence

The rise of cryptocurrency is not only a technological innovation, but also a profound reflection and challenge to the traditional financial violence system. It gives individuals the ability to regain control of wealth and provides new mechanisms and channels for the transfer of wealth on a global scale. As Satoshi Nakamoto said: “We no longer need to trust the central bank, we can trust the algorithm.”

Crows in the world are not ordinary black. One country has discovered the dangers of abuse of monetary sovereignty and has taken the initiative to embrace Bitcoin.

6. El Salvador proactively embraces Bitcoin

El Salvador took the initiative to embrace Bitcoin not only to deal with currency devaluation and inflation, but also to build a new financial system and get rid of the shackles of traditional monetary policy.

On September 7, 2021, El Salvador became the first country in the world to legalize Bitcoin. The government announced that Bitcoin will become legal tender on the same basis as the US dollar, a decision that has aroused widespread attention and controversy in the global financial community.

El Salvador’s President Nayib Bukele believes that the traditional monetary system is no longer able to meet the needs of the country’s economic development. Especially for poor people without bank accounts, Bitcoin provides a new kind of financial freedom. Through Bitcoin, Salvadorans can directly participate in the global financial system despite high banking fees.

According to data from the Salvadoran government, by 2023, more than 2 million citizens in El Salvador will use Bitcoin wallets (Chivo wallets), which accounts for about 30% of the total population. In addition, shops and businesses in El Salvador have also begun to accept Bitcoin as a payment method, and the tourism industry has also benefited, attracting a large number of Bitcoin enthusiasts and investors to travel, consume, and invest. El Salvador also plans to raise funds for the country’s infrastructure by launching Volcano Bonds, part of which will be invested in Bitcoin mining to further promote economic development.

Although this reform has brought short-term market volatility and a degree of international criticism, El Salvador’s Bitcoin experiment has become an important testing ground for the development of global blockchain and cryptocurrencies. There is growing demand for Bitcoin as an alternative currency in many developing countries, and El Salvador has undoubtedly become a pioneer in this trend.

However, El Salvador’s Bitcoin experiment is not without challenges. Due to the high volatility of Bitcoin’s price, El Salvador’s government must deal with market risks. For example, the collapse in bitcoin prices at the end of 2021 caused El Salvador to suffer huge losses in bitcoin reserves.

In February 2025, El Salvador’s Congress passed a new policy that eliminated the mandatory requirement that merchants must accept Bitcoin payments, and limited taxes to U.S. dollars only. However, El Salvador has not given up Bitcoin’s status as legal tender, but has adjusted relevant policies to ease external pressure.

Interestingly, in such a crypto-friendly country, there is not strong demand for cryptocurrencies. A survey showed that only 7.5% of respondents said they used cryptocurrency for transactions, and 92% had never used cryptocurrency. Still, El Salvador plans to build a new capital market around Bitcoin and is preparing to launch more regulatory support policies.

Obviously, El Salvador is an anomaly, an anomaly that voluntarily abandons its monetary sovereignty and embraces Bitcoin. Although, it is still unknown whether this top-down reform will ultimately succeed. However, the government’s initiative to return the right to choose which currency to the people is a great step forward.

So why are no more countries following suit? For example, in Nigeria, why hasn’t the issue of exchange rate depreciation been solved after they drove away Binan?

7. Binan has gone, why does the exchange rate continue to fall?

The reason is simple. Although Binance is the largest exchange, it is not the only exchange.

For many Nigeria, Binance is just a bridge to the cryptocurrency world, and there are many other bridges to go on. As long as there is a demand for cryptocurrency, you can take any bridge.

This is exactly the case. After Binance left Nigeria, the Naira exchange rate briefly rebounded to 1100 NGN to 1 US dollar in April 2024, but soon fell back to the historical low of 1500 NGN.

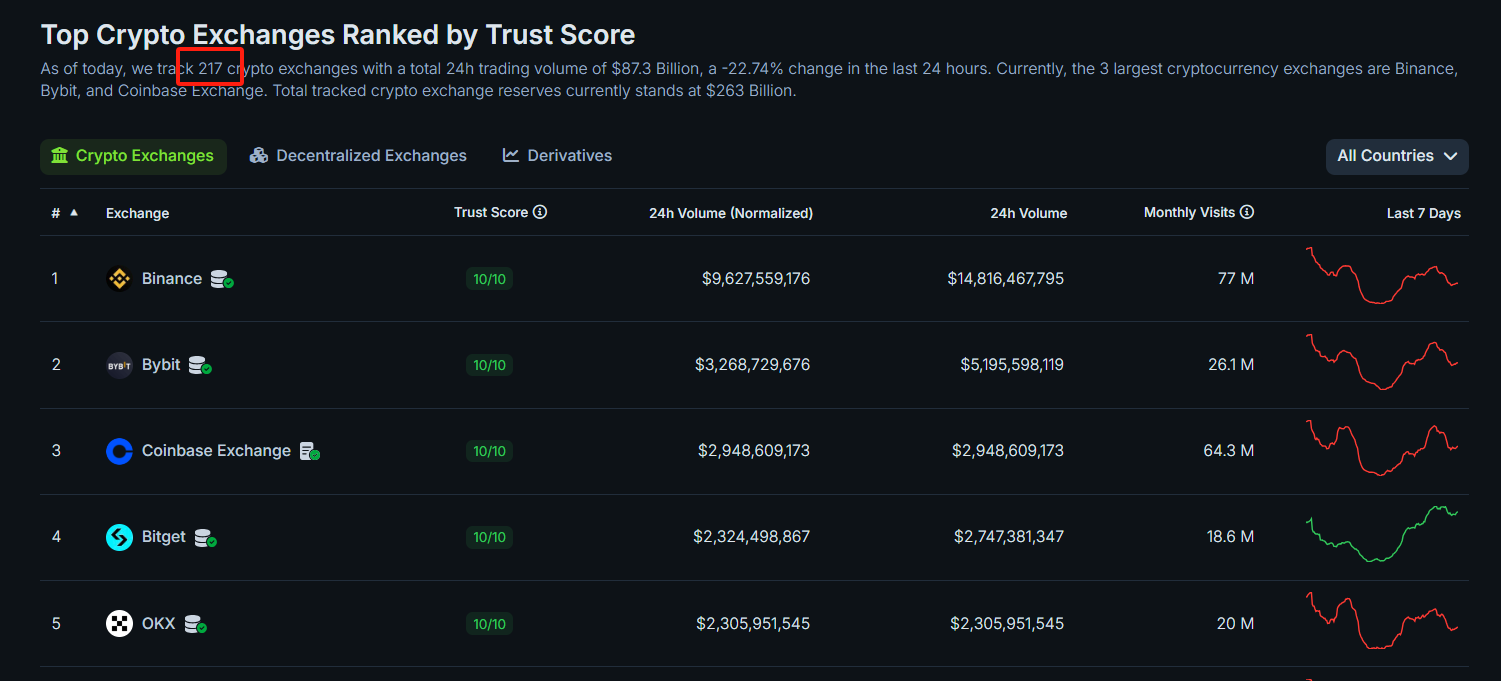

There are now 217 exchanges similar to Binance on earth. Among them, many platforms also provide P2P transactions to help people bypass foreign exchange controls and convert naira into U.S. dollar stablecoins or Bitcoin. The existence of these exchanges not only quickly filled the gap left by Binance after leaving Nigeria, but also formed a huge cryptocurrency circulation network around the world.

With the rapid development of the global cryptocurrency ecosystem, competition among major exchanges has become increasingly fierce. The differences between platforms are mainly reflected in user experience and fees, but for people who urgently need to avoid currency devaluation, there is almost no doubt about the substitutability of platforms.

Binance has undoubtedly become the scapegoat for Nigeria’s currency crisis. By killing the scapegoat, Nigeria’s problems remain and will not be solved. As for how to solve the problem of currency devaluation, this is a matter for the Nigeria government and it is not for outsiders to worry about.

The only thing we need to worry about is how to guard against state violence becoming accomplices in the decentralized financial revolution initiated by Bitcoin?

conclusion

In the shadow of national violence, monetary sovereignty was once a tool for the government to take whatever it wanted and a legitimate cloak for wealth plunder. The game between Nigeria and Binance is just the tip of the iceberg projected by this power game.

When the cornerstone of the traditional financial order began to loosen, the rise of cryptocurrencies was not just a wave of technology, but also a profound rebellion against “legal violence” currency plunder. It heralds the arrival of a new era: the wave of digitalization is deconstructing the old order, the definition of wealth will be rewritten, and individuals will regain economic sovereignty in a decentralized network.

In the future, the boundary between countries and individuals will be redrawn, and cryptocurrency may become a key force in reshaping this boundary, ultimately pointing to a more balanced and dynamic new picture of the global economy.

However, before the new picture is realized, we must remain highly vigilant and examine the power logic behind every technological advancement, so that we can find the “free channel” that truly belongs to us in the complex economic and political situation.

Because, in the long river of history, money has never been a pure tool of exchange, it has always been a symbol of power.

With the rise of blockchain, the function of currency’s value measure is being rediscovered. Perhaps this is the beginning of our redefinition of “wealth” and “freedom.”

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern