From its original vision to a three-phase deployment to ultimately form a multi-chain security market, Babylon innovatively redefines the way Bitcoin interacts with the advanced blockchain ecosystem.

Author: Reflexivity Research

Compiled by: Shenchao TechFlow

introduction

In the past ten years, Bitcoin has firmly ranked first in the world’s cryptocurrency due to its security and value. Its design is simple and untamperable, combined with the PoW consensus mechanism, making it a leader in the field of digital assets. However, although the market value has reached approximately US$2 trillion, Bitcoin’s potential in more complex blockchain applications has not yet been fully realized.

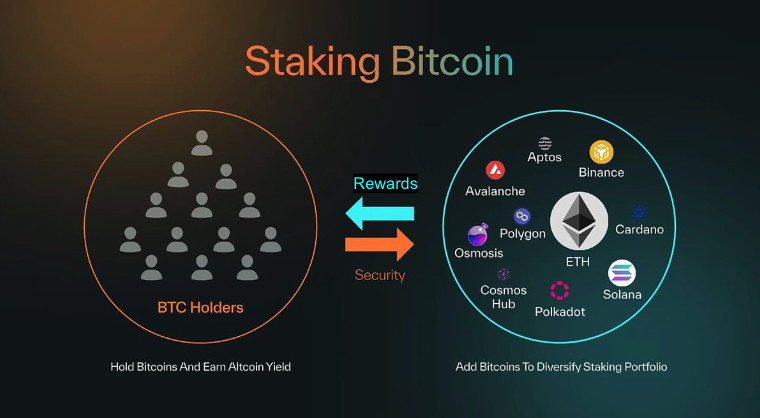

In contrast, PoS networks used by other cryptocurrencies such as Ethereum, Solana, and Cosms-based chains have demonstrated the economic potential of pledges and smart contracts, spawning prosperity in areas such as decentralized applications (dApps), liquidity provision, and lending. However, many PoS chains face financial difficulties at start-up, making it difficult to gather enough capital to build a strong validator community and withstand attacks.

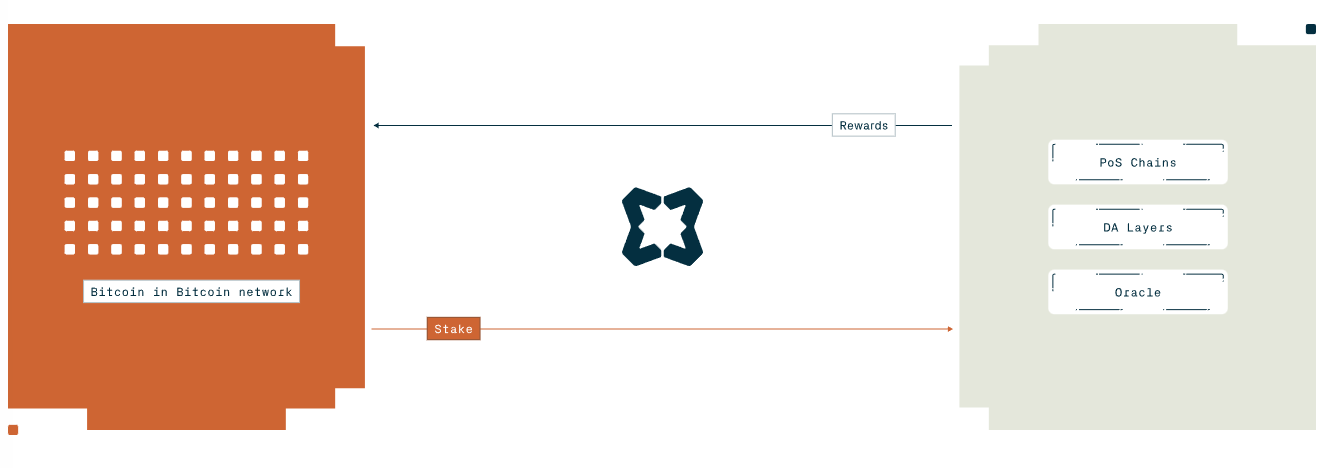

The Babylon protocol came into being, aiming to integrate the advantages of Bitcoin and various Layer1 PoS platforms to unlock the capital value of Bitcoin without requiring trust intermediaries and directly anchoring the Bitcoin blockchain. Babylon does not convert BTC into packaging assets through bridges and does not rely on large custodians, but builds Bitcoin’s pledge infrastructure by creating a unique Layer1.

In other words, Babylon is not a Bitcoin sidechain or bridging-dependent L2 solution, but an independent and fully functional Layer1 developed based on the Cosms-SDK. It can run its own dApps and support the entire ecosystem, while gaining financial security from Babylon’s Bitcoin Pledge Protocol.

This report will take an in-depth look at the design of the Babylon protocol, focusing on its characteristics as Layer1, its mission to bring practical value to Bitcoin, and the ecosystem that has gradually formed around it.

Babylon as Layer 1

Babylon’s core goal is to provide support for Bitcoin pledges, but its team has positioned Babylonchain as Bitcoin Security Networks (BSNs), competing head-on with mainstream Layer1 such as Ethereum, Solana, and Sui to attract developers, users and funds into the Bitcoin ecosystem. Unlike solutions that rely solely on bridges or deploy smart contracts on other chains, Babylon builds a chain that has the following capabilities:

-

Set consensus rules independently, and can evolve independently.

-

Uses Cosmos SDK, Integrated Cross-Chain Communication Protocol (IBC).

-

Support own dApps, allowing developers to play their best in a Turing complete environment, while at the same time being linked to the security of Bitcoin.

-

Manage real BTC pledges on the Bitcoin main network through dedicated on-chain logic。

Babylon hopes to compete with Layer1 such as Solana or Sui through its high throughput, active developer community and large user base. Its unique advantage is that Babylonchain’s structure incorporates pledged BTC rather than simply relying on the market value of newly issued tokens to ensure security.

Babylon L1 itself is a PoS-based blockchain that runs consensus by selecting verifiers and ultimate providers (FPs) based on the number of BTC entrusted. Instead of bridging BTC to the chain, users directly lock BTC into a specific script on the Bitcoin blockchain, and then delegate voting rights to FP on Babylon. This means that no third-party custodian holds BTC and the pledger always remains self-custodial, which is the core of Babylonchain’s security model.

Babylonchain’s security model

Babylon’s BTC pledge infrastructure and Babylonchain both adopt multi-level cryptographic security mechanisms, giving it a leading position in the BTC pledge ecosystem. The specific operation is as follows:

-

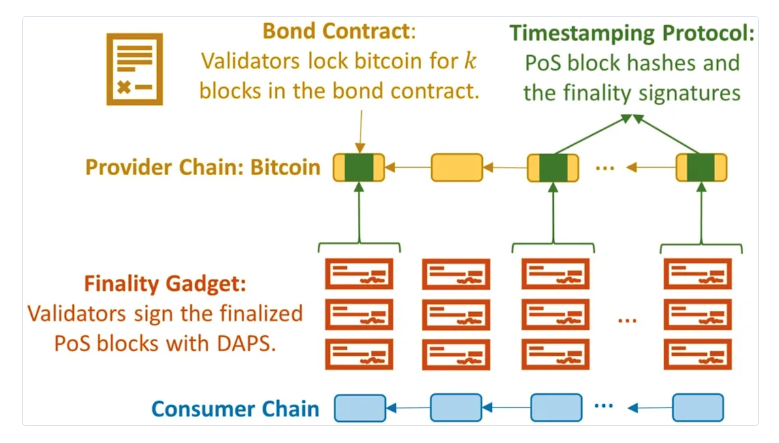

BTC locked in the Bitcoin backbone: Use a special script called a bond contract to ensure that funds cannot be moved until the pledger is untied or the pledge expires.

-

Utilize extractable one-time signatures (EOTS): Thanks to Bitcoin’s native Schnorr signature, if the verifier double signs the block, its private key can be extracted, and anyone can broadcast the transaction to destroy part of the pledged BTC on the Bitcoin chain.

-

Block final signature: The verifier signs the block with a special key on Babylonchain. If he signs the conflicting final state, he will face punitive losses.

-

Regularly anchored to Bitcoin: On-chain data is regularly embedded into the Bitcoin blockchain to ensure that long-range attacks or rollback conditions cannot be carried out without detection. However, for Babylon, timestamps are only part of its security architecture.

This layered design means that any malicious attack against Babylonchain or other BSNs will be blocked by the risk of actual BTC loss. This is why Bitcoin is known as the ultimate cornerstone of security. BTC that was destroyed cannot be easily restored.

Why build a separate Layer1?

Why not rely on existing infrastructure and build a new chain from scratch? Simply put, advanced pledge functions require more refined control of pledge logic, penalty mechanisms, and cross-chain coordination, which is beyond the capabilities of traditional bridging or contract-based solutions.

Babylonchain is unique in that:

-

Manage pledges and penalties: As Layer1, Babylonchain ensures that Bitcoin pledges are secure without trusting intermediaries, are enforceable and remain self-custodial. It implements a penalty mechanism by encrypting and extracting the private key when double signing, incentivizing integrity and deterring malicious people without having to place complex bridging contracts or sidechains on Bitcoin.

-

Empowering the developer ecosystem: Provide a Turing complete environment that allows developers to create dApps that rely on Bitcoin capital.

-

As an optional hub: Other PoS chains (even specific L2, oracle or data availability layers) can choose to purchase security from Babylon aggregated pledged BTC, and Babylonchain becomes the control center for these interactions.

Babylon not only solves technical security challenges, but also hopes to bring Bitcoin’s user base and brand influence into a new ecosystem. By attracting large amounts of liquidity and providing sophisticated developer tools, Babylon is determined to challenge existing Layer1 and has the path to achieve this goal.

Specifically, Babylonchain’s success relies on creating real utility for BTC:

-

Support native dApps: The ultimate goal is to create a DeFi agreement that accepts BTC as collateral while allowing users to retain control of their funds. However, as of the first quarter of 2025, the pledged BTC cannot be directly used for DeFi on Babylonchain, and currently relies on managed liquidity pledged tokens (LSTs). The LST service pledges BTC on behalf of users and mints tokens representing pledged positions on the PoS chain.

-

aggregate security: For emerging blockchains or L2 that want strong security quickly, Babylon can serve as an anchor point, providing bitcoin-level economic security while allowing pledgers to earn multiple rewards.

-

Bitcoin first developer experience: Many developers aspire to build apps on Bitcoin, but limited by its scripting language or bridging limitations, Babylonchain’s approach makes the process easier.

Three phases of mainnetwork deployment

Babylonchain’s main network deployment is divided into three phases, each focusing on a different goal. This step-by-step strategy ensures that core subsystems are fully tested and that users, developers, and external PoS chains can keep pace with network evolution.

Phase 1 supply-side guidance

The first phase focuses on obtaining and organizing providers of Bitcoin pledges, laying the foundation for Babylonchain. Users pledge real BTC through a dedicated script on the Bitcoin main network to lock in funds in a self-custody manner. In the future, these pledgers will assume PoS voting responsibilities (or delegate them to FP) after the Babylon blockchain is fully launched. But in the first phase, the top priority is to verify user interest and test the pledge infrastructure.

The pledger locks BTC in the time-lock script through on-chain transactions, which usually has a lock-up period of approximately 15 months. The first stage deliberately prohibits the penalty mechanism, that is, the pledger does not need to be punished for improper behavior. This design aims to reduce complexity and allow participants to freely attempt pledge and unbind.

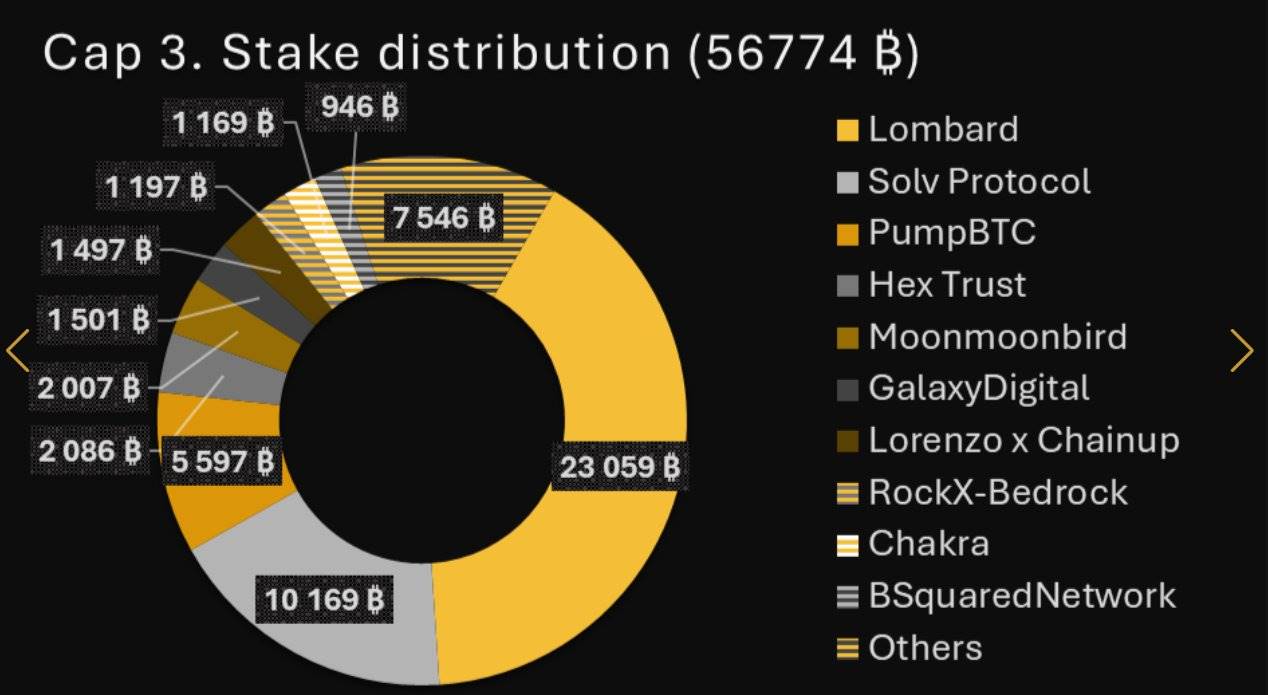

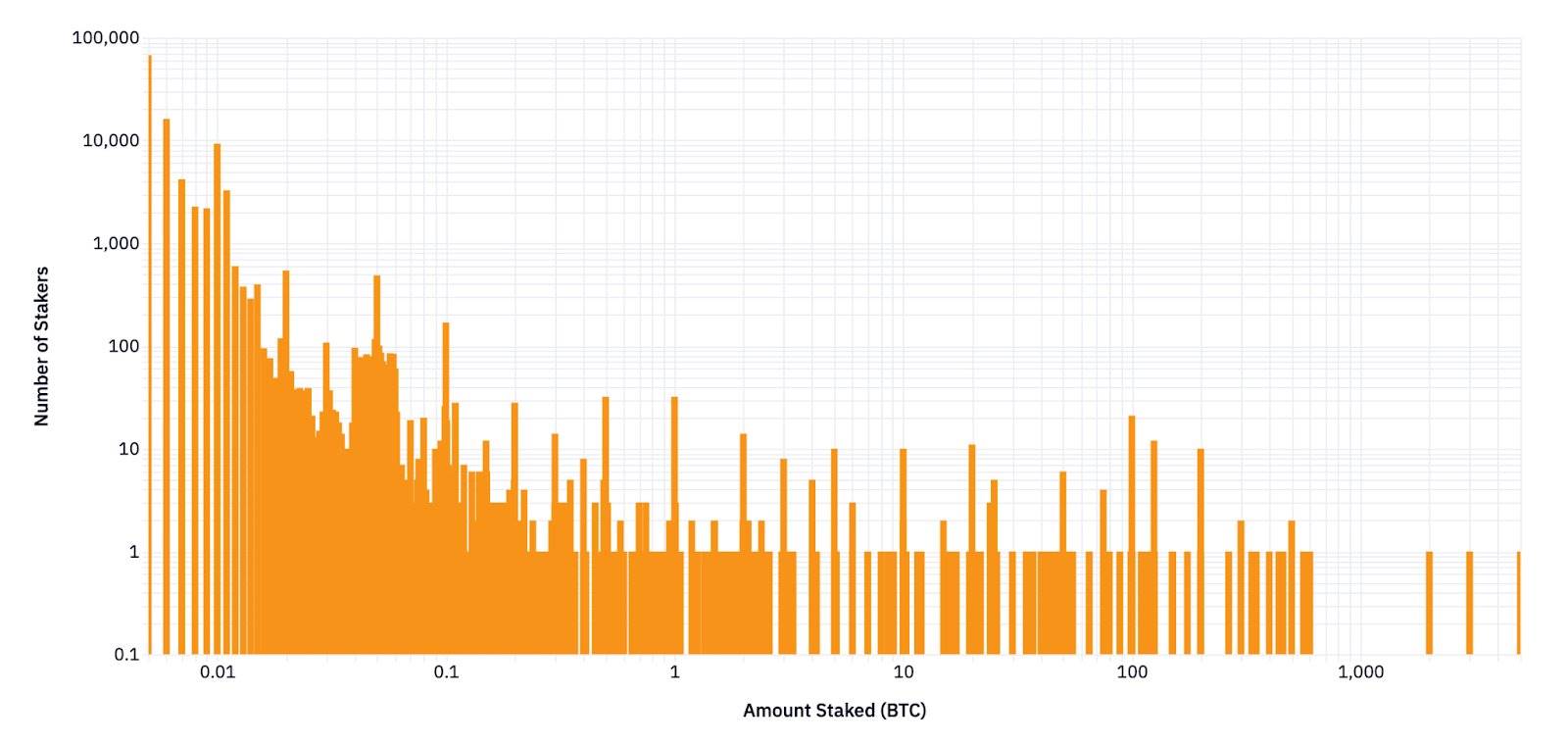

Initially, the agreement set a pledge cap of 1000 BTC to test interest and infrastructure. More windows (Cap-2 and Cap-3) were subsequently opened to allow more BTC to flow in. By the end of the first phase, more than 56,000 BTC had been pledged, and the number of pledgers exceeded 135,000. In December, a well-known entity pledged 10,000 BTC, demonstrating strong confidence in its trustless design. In the first stage, these upper limits were used to verify the demand and trust of diversified holders in the self-custodial BTC pledge model.

In addition, the agreement uses a points mechanism rather than direct token rewards to track pledger participation, measure the amount, duration and associated FP of BTC pledged, and evaluate user activity without allocating native tokens in advance.

Based on the success of the first phase, the second phase will transition Babylon from pure pledge to a fully operational blockchain, implementing Bitcoin pledge security on a large scale. Locked BTC changes from placeholders to proactively protecting assets. FPs with sufficient BTC commissions will directly participate in Babylonchain’s on-chain consensus.

The BTC locked in in the first phase became the economic pillar of the Babylonchain PoS Consensus. FPs (and self-delegated pledgers running their own nodes) are responsible for block finalization and verification, and malicious behavior will lead to real financial losses. After the penalty mechanism is launched, any violation of the consensus rules will trigger the destruction of Bitcoin’s main online pledge of BTC.

The second phase continues to use Bitcoin for anchoring, and the upgraded timestamp protocol regularly embeds Babylon’s key events into the Bitcoin block to prevent malicious rollbacks.

Transition from placeholder to true security

In the first stage, pledgers preset BTC; now, these capital actively supports Babylonchain’s consensus. This shift allows the network to have a strong security budget from its inception, which is extremely rare for new chains. The second phase also makes Babylon a direct competitor to the existing Layer1, standing out by relying on punitive BTC rather than a purely native token economy.

The impacts on Babylon’s ecology include:

-

Increase verifier responsibilities: After the penalty mechanism is launched, FP and verifier must maintain flawless key management and behavior, otherwise they will permanently lose their pledged BTC.

-

Developers flock in: The high-security, BTC LST-supporting on-chain (licensed) CosmWasm attracts dApp developers who want to reach Bitcoin users.

-

Promote multiple pledges: After stabilizing under Babylon’s own PoS consensus, it turned its attention to providing cross-chain security for other networks. Success in the second phase is crucial to building confidence in multiple pledges.

Phase 3 Multiple pledges and widespread adoption

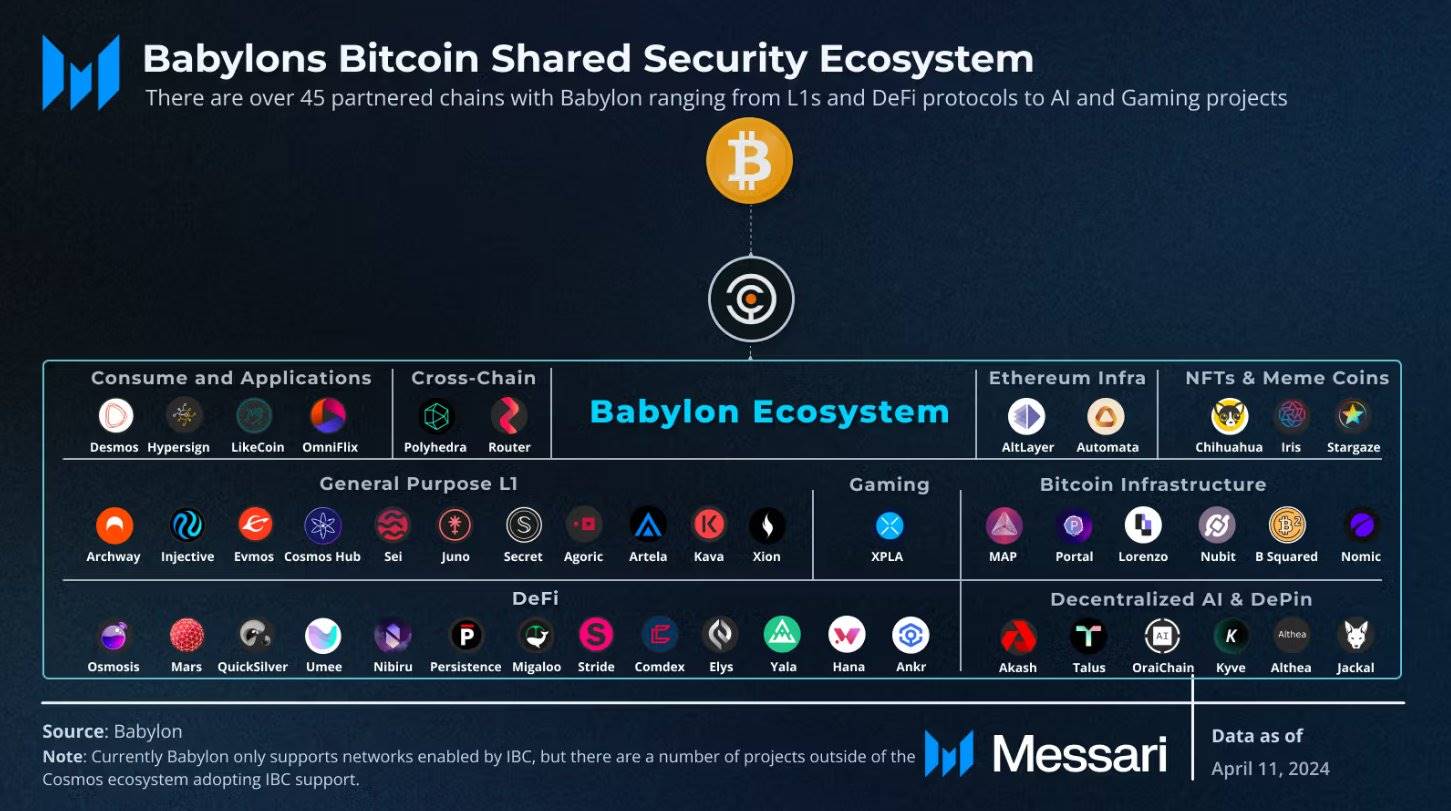

The third stage achieves Babylonchain’s goal of creating a multi-chain security market. Each unit of BTC pledged can protect multiple PoS systems at the same time. Babylon aims to become the hub of choice for BSNs, opening up its BTC reserves to blockchains that want to rent security verification capabilities.

Specifically, users (or FPs) can allocate their BTC pledges to multiple PoS networks, each offering native token rewards. This has formed an ecosystem: pledgers earn superimposed profits, and the consumer chain receives strong protection from the economic power of Bitcoin. Any PoS chain, L2, oracle or data availability project can choose to add Babylonchain security. These chains, known as Bitcoin Security Networks (BSNs), outsource some of their consensus security to Babylon’s pledged BTC and pay stable rewards or fees to participants.

Babylonchain oversees the cross-chain pledge process, verifies commissions, collects malicious evidence, and imposes penalties when necessary, ensuring that security standards are consistent for all participating networks.

Impact on BTC holders

Pledges can decide how to allocate BTC among consumer chains and earn diversified tokens and rewards. This subverts the traditional narrative of Bitcoin as a static store of value, making it an active asset with multiple revenue opportunities without sacrificing the trustless security of the Bitcoin main network.

As more chains compete for Bitcoin security and provide competitive APRs, market demand for holding and pledging BTC may increase, which may change mainstream investors ‘perception of Bitcoin’s utility in the long run.

Babylon Ecosystem

One of the notable successes of the first phase of the Babylon Bitcoin Pledge Agreement has been the emergence of new collaborations. More than 150 FPs, including well-known institutions such as P2P, Galaxy Digital and InfStones, have registered to receive BTC commissions. Large custodians such as Anchorage Digital and Hex Trust have also integrated with the protocol, allowing institutional customers to natively pledge BTC.

In addition, a wave of liquidity pledged token (LST) agreements has emerged around the first phase, allowing users to easily lock in BTC and hold derivative tokens representing pledged positions. Projects such as Lombard, PumpBTC, and Lorenzo have launched special activities to manage tens of thousands of BTC.

These developments demonstrate the widespread demand for BTC rewards and also indicate the greater potential of Babylon Layer1 once it is launched:

-

DeFi protocol: BTC can be used for underlying chain security and as collateral in lending pools or decentralized stablecoins.

-

Data availability and oracle services: Projects that rely on cross-chain data can leverage Babylonchain’s aggregated security.

-

Innovative dApps: With CosmWasm, developers can build advanced financial and social applications, all backed by real BTC mortgages.

Lombard

Lombard is a key partner of Babylonchain and is committed to integrating Bitcoin into reward generation activities while remaining self-custodial. Lombard recently received support, and its method of flowing bitcoins is closely linked to Babylon’s pledge base.

LBTC (Mobile Bitcoin) Tokens

The core of Lombard is the LBTC token, which serves as a tradable chain certificate to pledge BTC in the Babylon agreement. Users deposit BTC at an address controlled by Lombard, and Lombard pledges and casts LBTC on his behalf. Users can use LBTC for lending agreements, decentralized exchanges or other revenue strategies, while pledging BTC to contribute to Babylonchain’s security market. The partnership represents a win-win situation: Lombard helps users stay mobile, while Babylon gets more BTC pledges, strengthening both ecosystems in the process.

PumpBTC

PumpBTC is a user-oriented liquidity pledge platform that helps BTC holders maximize their revenue potential on the chain. It is rooted in Babylon’s native pledge model.

PumpBTC simplifies the pledge process by issuing transferable assets after users pledge BTC through the self-managed script of the Babylon protocol. This asset serves as a ticket to multiple DeFi strategies, allowing users to lock in BTC while maintaining liquidity. The PumpBTC platform itself proactively looks for opportunities in multiple PoS chains integrated with Babylon. As more networks become Bitcoin’s safe networks, PumpBTC can channel pledgers ‘funds into environments with the highest returns, strengthening an expanding market based on BTC returns.

Because PumpBTC inherits Babylonchain’s trustless and punishable security, participants are protected from typical cross-chain risks. In the case of verifier misconduct, punishable pledges ensure that malicious actors face real financial penalties, reducing the likelihood of network-level exploit.

Lorenzo

Lorenzo is an L2 infrastructure that extends Bitcoin’s utility to complex revenue operations. It connects directly to Babylon’s pledge mechanism to ensure that its BTC holders can participate in advanced DeFi scenarios without giving up autonomy. At the same time, Lorenzo offers structured financial products such as automated market making or derivative positions, with all benefits supported by Babylon’s safety baseline. The project provides native aggregation to manage complexity offline, while regularly rolling back to Bitcoin to ensure reliability. By partnering with Babylon, Lorenzo ensures that both the finality of aggregation and verifier integrity are supported by cuttable BTC, reducing the need for external trust.

By interoperability with the Cosmos ecosystem and other IBC-enabled networks, Lorenzo’s L2 can seamlessly transfer data and value between different chains. BTC holders can therefore use a variety of dApps, liquidity pools and pledge markets.

Bitcoin Security Network (BSN)

As the third phase approaches, multiple PoS chains have announced plans to become BSNs on Babylonchain, including Corn. Becoming a BSN means that these chains are officially integrated with Babylonchain, bringing several strategic advantages to the PoS chain:

-

On-demand security: Each chain can pay rewards to Bitcoin (BTC) pledgers to borrow shared security.

-

IBC and Interoperability: Babylonchain is built on the Cosmos SDK and the Cross-Chain Communication Protocol (IBC), and the integrated network can communicate seamlessly with it. This creates a smooth environment where tokens, data and security can flow freely between chains in a trustless manner.

-

Multi-chain pledge economy: A pledger’s BTC may earn small amounts of revenue from each of five different networks, but these gains may add up to exceed the return of traditional BTC bridging or lending markets, providing significant incentives to the pledger.

The goal of this layered security mechanism is to bring an Ethereum-like re-pledge effect to Bitcoin, but it uses BTC as the ultimate capital base and runs entirely on Babylonchain.

Developer empowerment and dApp potential

For an emerging native Layer1 chain, attracting and supporting an active developer community is one of the core elements of development. Babylon achieves this goal through thoughtful measures, such as providing highly flexible smart contracts through CosmWasm, supporting scalable logic, and being compatible with a wide range of DeDeFi and NFT use cases. In addition, Babylonchain supports cross-chain communications (IBC), allowing it to work directly with the broader Cosmos ecosystem, allowing dApps on Babylonchain to access a huge mobility pool and even share a user base across multiple IBC-supporting chains.

These two features are very attractive to dApp developers, but Babylonchain believes that its ability to natively access Bitcoin is a icing on the cake for other Layer-1 ecosystems. Although it does not replicate Bitcoin’s PoW environment, it provides remote pledges that can be integrated at the contract level. Developers can build applications that rely on punitive pledged BTC for use in fields such as finance and games to minimize reliance on trust.

Bringing practicality to Bitcoin

To understand the far-reaching significance of the Babylon agreement, consider what it means to Bitcoin as an asset. Historically, Bitcoin has two undisputed native uses:

-

Holding (store of value)

-

Consumption/transfer (medium of exchange)

In addition, from receiving packaging tokens from bridges to borrowing money on a centralized platform, you need to rely on external entities or custodians. Babylon introduces pledge into Bitcoin’s native use case, allowing BTC holders to protect the PoS network without the need for custodians or packaging assets. It also has the following unique advantages:

-

No trusteeship: Pledges do not need to hand over BTC to a third party, they lock it in a dedicated script on the Bitcoin chain.

-

Punishable: If the pledger’s key maliciously signs the block (e.g., double signature to attack the PoS chain), the key will be encrypted and exposed, allowing the corresponding BTC to be destroyed.

-

Self-hosting: Users can unbind and extract BTC from the pledge script at any time, subject only to the unbind schedule. After the unbinding period expires, the user resumes holding ordinary BTC UTXO.

The impact on Bitcoin is huge. For the first time, BTC holders can earn pledge rewards through a process that minimizes trust, while retaining the concept of Bitcoin’s self-sovereignty. At the same time, the broader ecosystem has gained penalized access to the largest crypto assets, an unprecedented form of capital injection.

conclusion

From its original vision to a three-phase deployment to ultimately form a multi-chain security market, Babylon innovatively redefines the way Bitcoin interacts with the advanced blockchain ecosystem. Babylon Labs didn’t just focus on bridging or timestamps, but created a complete Layer1 environment that leverages the economic power of Bitcoin. This method has been verified by tens of thousands of BTC pledgers at one stage, reflecting users ‘strong demand to transform BTC into assets that can bring rewards and ensure chain security.

Looking ahead, Babylonchain’s trajectory will reshape discussions about using Bitcoin. For the first time, BTC holders gain a truly native way to earn returns, while decentralized networks gain a reliable source of security. As Babylonchain Layer1 matures, developers can build dApps that combine Bitcoin’s robust monetary attributes with the expressiveness and scalability of the PoS blockchain.

Disclaimer: This report was commissioned by Babylon Labs. This research report is just a research report. It is not intended as financial advice, and you should not blindly assume that any information is accurate without confirmation through your own research. Bitcoin, cryptocurrencies and other digital assets carry significant risks, and nothing in this report should be construed as an endorsement of the purchase or sale of any asset. Don’t invest more than you are willing to bear, and understand the risks you take. Please study by yourself. All information in this report is for educational purposes only and should not be used as the basis for you to make any investment decisions.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern