There are not many negative factors left at present, so we can focus on the good news that may arrive on March 7.

Author:Crypto Stream

Compiled by: Tim, PANews

Is this the best time to buy bitcoin?

The market plunged 10% overnight, completely offsetting the rising effect of the U.S. strategic cryptocurrency reserves. Retail investors are selling in panic and market sentiment has dropped to freezing point. But the actual situation may be better than it appears. Here are my market views:

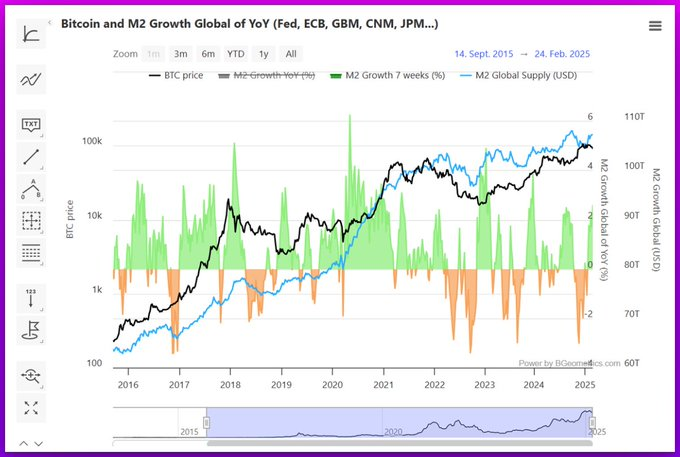

Why can the global M2 money supply drive Bitcoin up?

Bitcoin is extremely sensitive to changes in the global money supply. As the most sensitive asset to liquidity changes (a term coined by CrossBorder Capital, a global liquidity research firm), experts estimate that its correlation with the money supply is as high as 40%.

Analysis of the current trend of M2 money supply:

M2 supply has bottomed out around January this year. Historical data shows that the impact of M2 on Bitcoin prices has a 40-70-day lag effect. This means that its bottom-up liquidity will likely drive Bitcoin up in the medium term, and this transmission mechanism may take effect as soon as 20 days later.

Analysis of the Impact of Tariff Policies on the Market

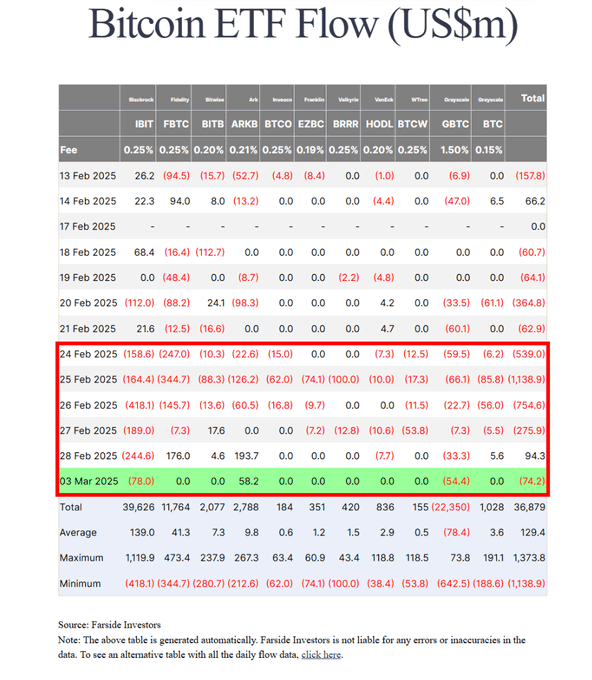

Trade war fears are hitting markets, and the decline in risk appetite in the United States poses a significant negative for risky assets. However, I think the impact of tariffs has been fully absorbed by the market. The primary verification indicator is the flow of ETF funds:

Changes in ETF fund flow and market expectations

Currently, the outflow of funds from ETFs has slowed down significantly. Institutional investors have basically completed pricing the impact of tariffs last week. No larger withdrawal of funds is expected this week. It is noteworthy that the market has shown signs of inflow of bargain hunting.

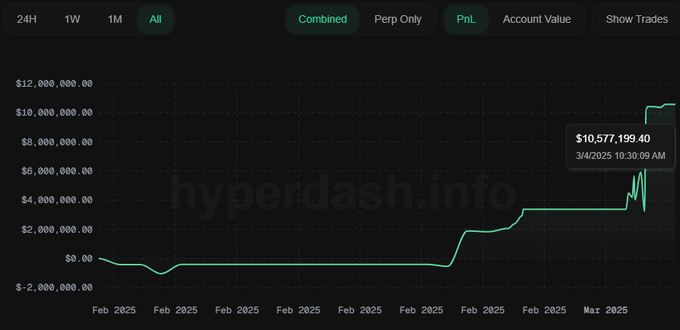

Analysis of selling crowd

The current selling pressure mainly comes from two major groups: retail investors who sell in panic, and institutional players who are well prepared. It is worth noting that retail investors may have misjudged expectations of policy delays.

Technical Analysis of CME Futures Gap

Another potential negative factor is the CME Bitcoin futures gap. This phenomenon refers to the gap between the bitcoin spot price and the futures opening price when the CME exchange is closed for the weekend. Although the gap does not necessarily trigger an immediate sell-off, traders ‘widespread psychological expectation that the gap must be filled will exacerbate short-term selling pressure. It is noteworthy that this technical gap was completed on March 4, and this influencing factor has been eliminated from the current price equation.

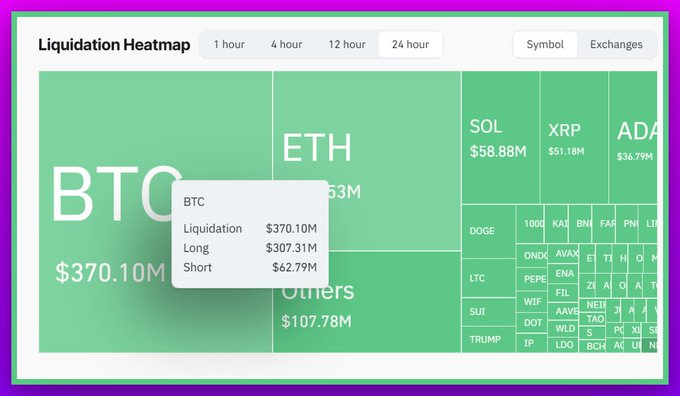

Based on the above analysis, we can summarize the three core drivers that caused yesterday’s price fluctuations:

•Insiders short after announcement

•Long positions were forcibly closed

•A flood of new short positions

Finally, I don’t think there are many negative factors left at the moment, and we can focus on the good news that may come on March 7.

The BTC price has fallen back to the level it was before the announcement, and I think buying at the current level has an excellent risk-reward ratio.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern