In Xiaohongshu, emotional, situational, and conflicted content is more likely to become hot spots, which is inconsistent with the “stable” attribute of the insurance industry. From a practical point of view, the insurance industry and even the entire financial industry seem to have failed to make a real “big deal” in Xiaohongshu, whether it is content or IP.

whale observation| Insurance institutions “operate” small red books: mostly limited to brand display, grass planting logic encounters transformation difficulties

(Photo source: Visual China)

Blue Whale News, March 6 (Reporter Shi Yu)From insurance brokers rushing to Xiaohongshu and each person has an active account, to insurance institutions officially entering the market to open blue v accounts, the insurance industry is deeply exploring how to develop Xiaohongshu’s large-traffic platform, which earns 300 million yuan a month.

According to Blue Whale News reporters, unlike brokers ‘demands for platform customers, insurance companies’ needs are currently more focused on brand display and building customer communication platforms, trying to tear off the label of high cold with life-style scenes and compete for young families. Decision-making mind.

However, behind the traffic carnival, issues such as lengthy conversion links, high mobility of agents, tearing up the stability of the content matrix, and content compliance supervision are intertwined, exposing a certain mismatch between the logic of grass planting and the attributes of the insurance industry. On the one hand, there is a long-term expectation of seizing the traffic entrance, and on the other hand, there is a vague exploration of the commercialization path. When insurance companies enter, can they explore how to convert traffic and precipitate brand value? Platforms and institutions also need to find a balance.

Official title wind direction: direct content, eye-catching cover, integrated into life-oriented scenarios and cross-circle operations

“The 2024 echelon inventory of major insurance companies. In the DRG/DIP era, how should we configure medical insurance? Welcome to the Insurance chapter of “Legend of Zhen Huan”. On the Xiaohongshu attention page of insurance broker Xiaoye, insurance-related content has become the absolute main force. During the two years when she opened her personal account through Xiaohongshu and carefully operated it, she was a practitioner and observer of the insurance + Xiaohongshu model.

Insurance brokers are the first batch of people to test the insurance content of Xiaohong Book and are also the most active participants. After that, sales departments and insurance intermediaries entered the market one after another. At the same time, insurance companies successively registered the small red book number with their official identities to jointly seize the traffic entrance.

Blue Whale Journalists observed that after Ping An, China Life Insurance, AIA, Dehua Angu Life Insurance, Allianz Insurance and other insurance institutions successively entered Xiaohongshu in the early days, in the past year, more and more insurance companies have joined in opening Xiaohongshu official accounts.

Photo source: Xiaohongshu

On February 27, Xinhua Insurance officially announced its entry into Xiaohongshu. The first article introduced the company’s latest performance in the form of a video. The reporter learned that some insurance institutions are also in contact with Xiaohongshu and related suppliers to prepare for the next step in.

Reviewing the official accounts opened by insurance companies in Xiaohongshu, we can find that the release content mainly focuses on insurance knowledge popularization, financial tips, and company introduction. Different from Weixin Official Accounts, the content on Xiaohongshu is more lively and fancy in form, and videos and simple pictures and texts are the absolute main force.

The dual-column waterfall layout of the Xiaohongshu page can achieve efficient display of diverse content, but it also allows users to decide whether to enter the content to view the body within a few seconds based on the cover and title. Therefore, the operator of the insurance account must Learn how to give it directly.

According to Xiaoye’s experience, articles on insurance product science and financial knowledge content that work hard on typography do have higher readings, but the interaction rate is not high. Later, she began to try life scenes and pain point resonance content to accumulate fans first, and then penetrate insurance.” ldquo; Knowledge about children’s meals and maternal and child health can attract exchanges among young mothers. Travel strategies are easier to plant grass. Knowledge related to travel insurance and social security is also content with a high amount of interaction. Xiaoye introduced it to reporters.

The experience of brokers is also applicable to the official accounts of insurance institutions. Many insurance institutions no longer stay in dry science popularization, but choose to break through across circles, cut in from the perspective of the living community that Xiaohongshu focuses on most, and integrate with users.

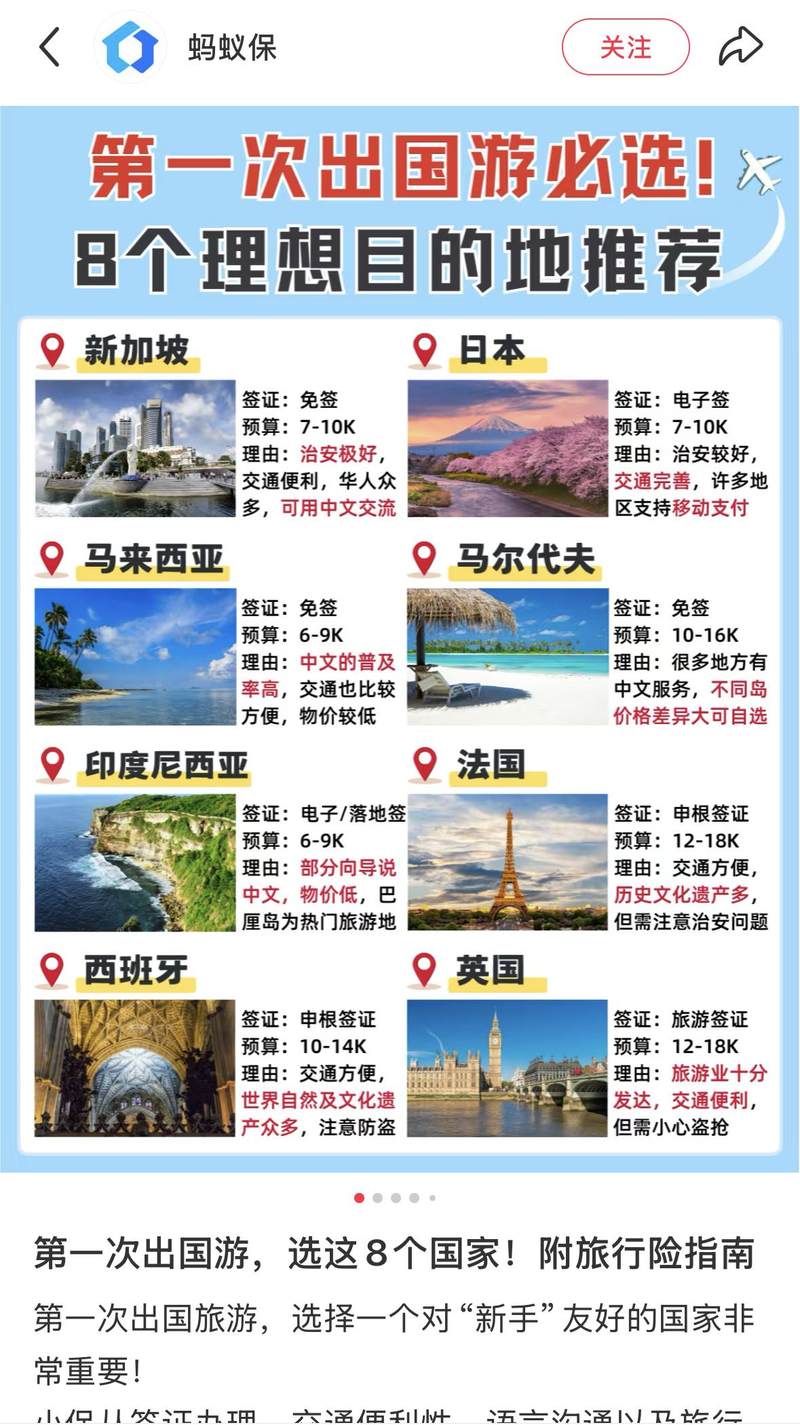

For example, the Ant Insurance Association released the “First Travel Abroad to Asia| Super fully prepare for the strategy! Collect!” “What should I do if a novice is rear-ended on the road? Here comes the guide!” Transition to product introduction with strategy content. Zhong ‘an Insurance has released a series of experience and sharing vlogs such as “In the Sky of Shanghai, Watching the New Understanding of the Sports Roll King Team Pilates” and “Not in Hong Kong, in Hangzhou, Watching the Media People’s Bar Opening” to improve account content. The richness and user activity.

Photo source: Xiaohongshu

Demand-oriented, official accounts focus on brand display and integrate youthfulness”

“The tonality of the content depends on the needs of each institution, which is related to the attributes, scale, and brand positioning of each insurance company. After exchanges with reporters, relevant leaders of multiple insurance institutions gave relatively consistent views.

So what exactly are the requirements of insurance institutions for official admission?

Let’s start with Little Red Book’s perspective. Little Red Book, which has more than 300 million months of life, has high traffic appeal. In terms of user portraits, the main users of Xiaohongshu are concentrated around the age of 18-40, and are mainly in first-tier cities, of which female users account for about 70%.

“This group of people is usually the decision-maker of household consumption and the main component of insurance users. Xu Yuchen, a founding member of the China Actuarial Association, analyzed to reporters.

“Getting customers is not the main or direct purpose of insurance institutions. More companies still want to make a fuss about brands, said a relevant person in charge of the operation of his company Xiaohongshu.

Although the official account of insurance institutions attracts reader interactions or private messages, it needs to add corporate WeChat, assign agents, or enter official channels to purchase insurance. The conversion link is long and is easy to be lost during the journey.

This has also been supported by the industry. A brand leader of a medium-sized life insurance institution told reporters that his company chose to open an account based on brand display and promotion considerations, and on the other hand, it hoped to use the Xiaohongshu platform to increase exchanges with consumers based on consumer insurance considerations. A window for face-to-face communication. The official account content of the company where he works is mainly based on corporate consulting and financial tips, and is released in conjunction with the rhythm of festivals and practical topics.

“We hope that through Xiaohongshu, we can expand our influence among young consumers. We do not have too high requirements for the customer conversion rate of Xiaohongshu accounts. We hope that young users in Xiaohongshu can know and understand us. Strengthen the brand image of being young and warm, a relevant person in charge of an insurance institution said so. It said that interesting company introductions and occasional raffle activities are effective content output.

Xiaoye’s company has also opened an official account in Xiaohongshu. When users want to know about the company, I will directly @ the official account, which eliminates the need for users to go cross-platform to understand, and also increases their trust in me. rdquo;

Official testing water, unknown exploration under commercial expectations

The reporter noticed that although financial institutions are currently particularly active in settling in Xiaohongshu, they are still mainly banks and fund institutions, and insurance companies lag behind in terms of the number of institutions entering and the entry time.

For example, China Merchants Bank, which has the highest fan intake among banks, has currently gained 472,000 fans. Among insurance companies, Zhongan Insurance has 78,000 fans, Ping An of China has 31,000 fans, and China Life Insurance has 22,000 fans, which is already a high number of fans, even far lower than the number of fans such as Mercury Insurance Science and Deep Blue Insurance or individual employee accounts.

This may be mainly related to the differences in customer acquisition paths of different financial institutions. Xu Yuchen analyzed to Blue Whale News that when users have banking and securities-related needs, they usually have direct contact with the institution, and then the institution designates account managers and other personnel to provide services; When customers contact insurance, they usually communicate with front-line personnel first, and then reach links with the institution on the business side, thus forming a phenomenon that front-line insurance marketing personnel have become the vanguard of the Little Red Book layout industry.

In fact, entering the small red book is not complicated.

In terms of the entry process, the application for Xiaohongshu’s official account is similar to the process of registering for Weixin Official Accounts. Information is submitted to Xiaohongshu on a public-to-public basis for qualification review. A relevant person in charge of an insurance company told reporters that his insurance company will officially enter Xiaohongshu in an official capacity in 2024.

“There is almost no cost in the number opening process, and the investment cost mainly lies in post-maintenance, such as the labor cost required for content output, the purchase of quick response programs for connecting with private message users, etc. The above-mentioned relevant person in charge further mentioned, but the overall investment cost is not high, which is why the company is willing to try. rdquo;

But why don’t insurance companies seem to be very motivated?

“The company conducted inspection and research before entering the market. After all, opening an account is only the easiest step in terms of operation. The company needs to comprehensively consider how to carry out long-term maintenance of the account on the basis of compliance, consider the input costs and effects, etc., a person in charge of the brand of a personal insurance agency told reporters.

During use, we all hope to give consumers more brand exposure, insurance science popularization, and product grass planting, but this conflicts with the reality of accurate push by the platform and the construction of echo walls of interest by users. I don’t know how to break this kind of information cocoon room?& rdquo;, a relevant person in charge of an insurance company raised his doubts.

At the same time, in Xiaohongshu, emotional, situational, and conflicting content is more likely to become hot spots, which is inconsistent with the stable nature of the insurance industry. From a practical point of view, the insurance industry and even the entire financial industry seem to have failed to make a real hit in Xiaohongshu, whether it is content or IP.

Another reality is related to the highly liquid industry characteristics of insurance agents.

Insurance companies want to make a good layout on the Xiaohongshu platform, but it is obviously not enough to open an official blue V account. The most common method is the matrix layout model of KOB (official account)+ employee +KOL. Further, they will cultivate their own KOS (Key Opinion Sales) account. ldquo; However, the survey found that compliance monitoring of account content, content belonging to KOS, and the impact caused by the flow of agents behind accounts are all difficult dilemmas, industry insiders reported.

“For the insurance market, unlike traffic platforms such as Douyin, which are based on multi-ecological layouts and then relatively mature development of sales terminals, Xiaohongshu currently focuses more on content sharing from the perspective of grass planting. A person in charge of an insurance company brand told reporters that a mature platform on the sales terminal has limited bargaining space. We entered Xiaohongshu in the hope of finding an area with a high degree of commercialization and seeing if we can develop a new business model. rdquo;

The reporter learned from industry insiders that Xiaohongshu currently has no relevant policies such as support for the entry of financial institutions. Regarding whether to do further and how to expand and transform the commercialization of the financial sector, all parties need to continue to think and explore.