Original title: Reserve Your Ass

Original author: Foxi_xyz, encryption researcher

Original compilation: ChatGPT

Editor’s note: Trump’s announcement that cryptocurrencies such as SOL, XRP and ADA may be added to the U.S. strategic reserve has sparked discussions on the meaning of “mainland United States”, the possibility of establishing a cryptocurrency reserve, and its legal and political challenges. Although congressional appropriations may be circumvented through executive orders or confiscation of cryptocurrencies, a full establishment of reserves still requires congressional authorization and has legal and ethical issues. The market believes that it is possible to hold BTC reserves, but the author believes that only BTC reserves should be retained, and the addition of other cryptocurrencies will weaken the seriousness of reserves. In the author’s view, Trump’s move is more for advertising effect than for substantive policy changes.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Trump announced that the U.S. strategic reserves may be added to SOL, XRP and ADA.

Except for SOL, I think most speculators (including myself) are on the sidelines. This is probably the most important event since the BTC ETF and has many implications behind it:

·What does “Native America” mean?

·How likely is it to build a U.S. strategic reserve of cryptocurrencies?

·In what ways can the Ministry of Finance influence the formation of cryptocurrency reserves?

I’m not a political science major, but I saw a lot of interesting discussions. I will organize these discussions and add my personal perspective. Now that Trump has stepped in, we must admit that the rules have changed. How should we move forward?

(Yes, I know he also mentioned BTC and ETH, but this was obviously to make the ads less ugly)

What does “Native America” mean?

Thanks to @SonicAssistant’s research, most U.S. cryptocurrency companies have “foundations” overseas and there is no way to legally issue them in the United States:

· ADA, SOL, ETH -Switzerland

· XRP -Estonia

· HBAR, MATIC, SUI, APTOS, OP, ARB -Cayman Islands

As Movement founder @rushimanche said,”Politics is the most important market entry strategy for cryptocurrency companies today.” He predicts that only teams with strong relationships with federal agencies, institutional capital and world leaders will survive over the next five years. This vision strengthens true U.S. influence based on how effectively companies engage in political and institutional power-CABAL America.

Mint Venture partner @xuxiaopengmint also shared his views on the reserve announcement:

“Since Trump took office, SOL, XRP and ADA have frequently visited Mar-a-Lago (Florida) and provided substantial support to Trump, such as donations to his inauguration fund. Behind the scenes, various indirect interest transfers may be more widespread. In return, Trump is now using presidential power to provide a significant ‘advertising space’ for these tokens.”

How likely is it to build a strategic reserve of cryptocurrencies?

TL;DR: Very unlikely.

Administrative order authority?

The president can issue executive orders to activate or direct cryptocurrency reserves, but the order itself is not a magic wand. It must operate within existing laws or provide urgent reasons. Without a clear legal authorization to hold private cryptocurrency assets, the order may be considered illegal or ineffective unless backed by Congress. Trump can order research or pilot projects, or direct the Treasury to explore the use of the Exchange Rate Stability Fund (ESF) for cryptocurrency operations, but permanent, large-scale reserves such as BTC, XRP, SOL, and ADA may require congressional authorization first.

Bypass Congress?

The U.S. Constitution grants control of federal spending and asset purchases primarily to Congress (“fiscal power”). As a result, bypassing Congress to establish cryptocurrency storage is legally tricky. The president cannot allocate funds to buy assets-only Congress can authorize federal spending. In effect, this means that any direct purchase of cryptocurrency as a reserve requires Congressional approval (or reallocation of existing funds in a way Congress allows)

However, the federal government occasionally confiscates cryptocurrencies from criminal cases (e.g. Silk Road Bitcoin, the Dark Web Drug Market). Normally these are auctioned off for cash, but Trump’s team has the idea of directly adding these cryptocurrencies to the national reserve.

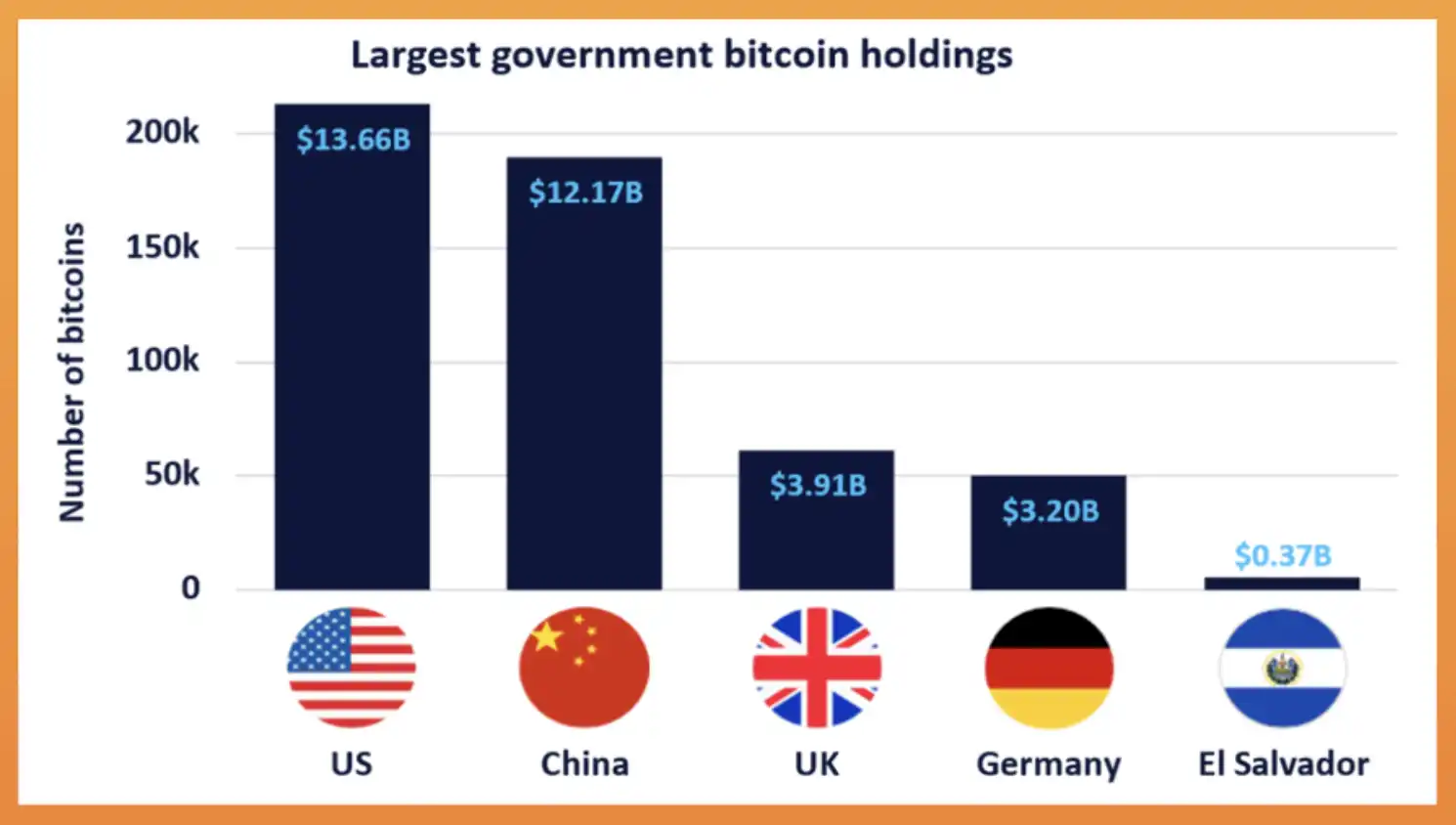

2024 data, not updated

Using confiscated cryptocurrency in this way can circumvent the need for congressional appropriations because the assets are already government property. This is essentially an asset transfer rather than a new expenditure. Importantly, this approach was explicitly considered: “Trump’s cryptocurrency team plans to consider using cryptocurrencies confiscated during enforcement operations to create reserves.” (From Reuters)

However, under existing forfeiture laws, proceeds from confiscated property typically must be used for specific funds (such as the Justice Department’s Asset Forfeiture Fund) or victims-recycling them into strategic reserves may require changes to those rules or national security reasons. Therefore, there is already some legal work to be done before XRP or SOL can be included in reserves.

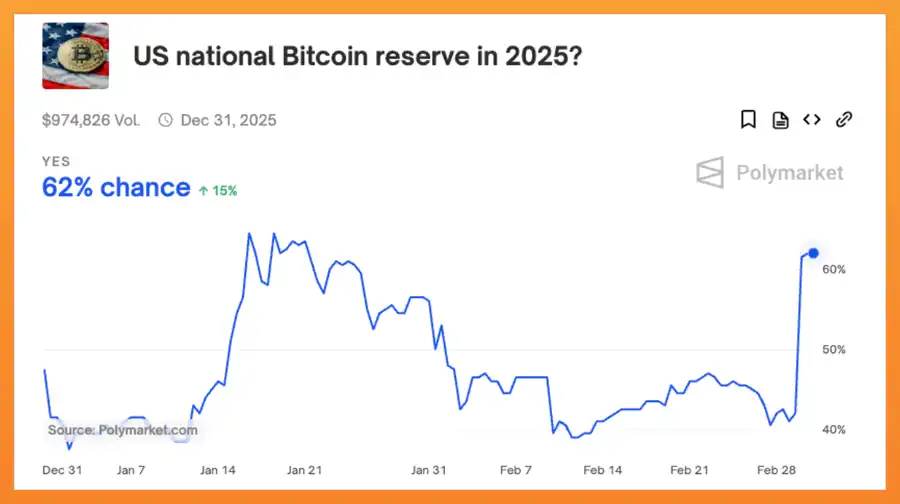

The market believes it is possible to hold BTC in reserves (ps is not a purchase)

Accepting token donations versus purchasing for reserve

One way to avoid using taxpayer funds and requiring congressional appropriations is to accept cryptocurrency donations into reserves. This idea suggests that cryptocurrency companies or wealthy holders may donate tokens (such as giving a large amount of XRP or ADA to the U.S. government for free) to kick-start strategic reserves. While this may seem convenient, this approach has significant legal and ethical issues.

Current regulations (such as the Treasury’s rules on accepting gifts) typically require that any gift (such as XRP to the Treasury) must be liquidated and used to reduce the national debt. In order for XRP and ADA to be successfully included in reserves, we need new legislation or reinterpretation that any donated assets will usually not be sold but will be held as reserves. This will have a lock-in effect and provide a huge advertising effect for cryptocurrency projects in the United States.

Possible forms of cryptocurrency reserves

Based on previous information, the most likely scenario:

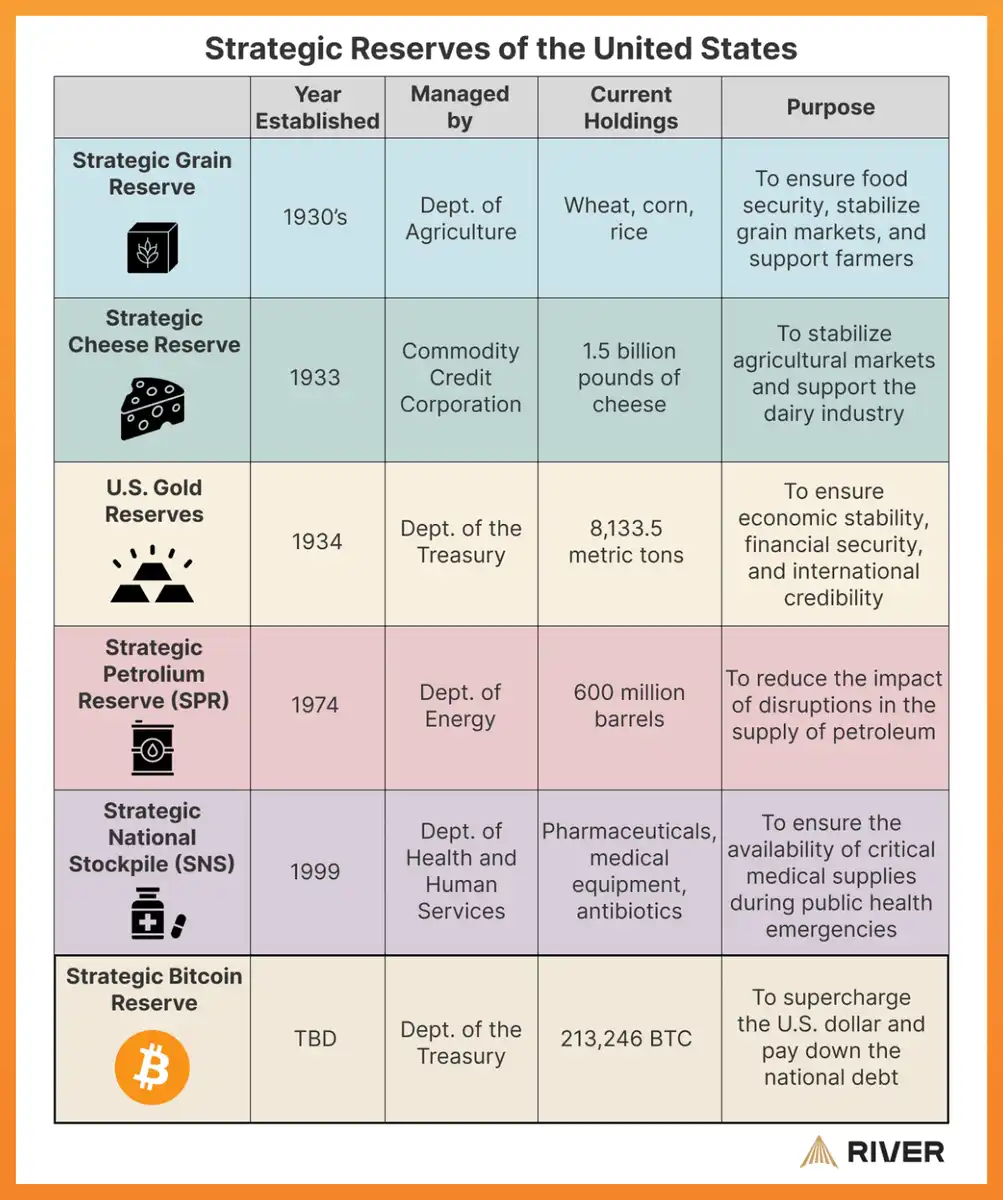

·Keep existing government-held bitcoin rather than liquidate it

·Allowing cryptocurrency companies to use cryptocurrencies (such as Bitcoin) to pay taxes

·Accept token donations from cryptocurrency companies

I personally only hope that the first scenario will occur “retaining existing government-held bitcoins rather than liquidating it.” Promoting ADA and XRP, or even ETH as reserve assets is ridiculous. Such a move would undermine the seriousness of dedicated Bitcoin reserves and further reduce the possibility of federal-level BTC reserve laws.

From @worldlibertyfi’s actions, we slowly understood that the entire game was just an advertisement. If you provide enough benefits to Trump’s cryptocurrency team, they will advertise for you. This is a very profitable business because Trump is the President of the United States and has more power than 99.9% of existing market institutions.

conclusion

Legally, while the president can direct executive agencies through orders or working groups, existing regulations (especially those governing the Federal Reserve and the Treasury) will restrict the unilateral creation of such reserves. In addition, Trump may prefer non-cash financing-by locking in government-held cryptocurrencies, encouraging cryptocurrencies to pay taxes or accept donations-which poses additional legal and ethical challenges, since current law typically requires any donated cryptocurrency to be liquidated to reduce debt.

Politically, the inclusion of alternative currencies such as SOL, XRP and ADA in reserves appears to provide public “advertising space” for favored projects. However, such a move could dilute the seriousness of any dedicated bitcoin reserves and face significant obstacles in Congress, as the fragile Republican majority makes comprehensive legislative changes unlikely.

I think we just need BTC reserves, not ETH, XRP, ADA or SOL, just BTC.

“Original link”