French fries specialty stores actively innovate around multiple dimensions such as taste, shape, side dishes and ingredients

The number of stores has surged by 45%. Will specialty chip stores be the next hit track?

Wen| Hongcan. com

In recent years, specialty stores focusing on French fries have risen rapidly around the world. From Europe, America, Japan and South Korea to Southeast Asia, and even the domestic market, specialty French fries stores have sprung up like bamboo shoots after rain, becoming a new force in the Western-style fast food segment. What is the current development status of domestic French fries specialty shops? What are the development highlights of the track? What is the future development trend?

Specialty French fries stores are developing rapidly, with the number of stores nationwide surging by 45%

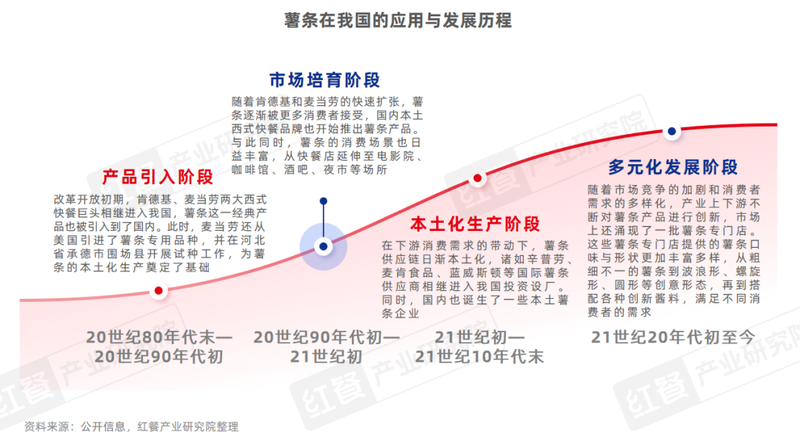

In the late 1980s, with the influx of Western fast food, the classic product of French fries was also introduced to our country. It has been taking root and developing in our country for nearly 40 years. During this period, the taste and shape of French fries products have undergone an evolution process from single to diverse. French fries have also been independently separated from the catering products of Western fast food restaurants by catering operators and built into specialty French fries stores.

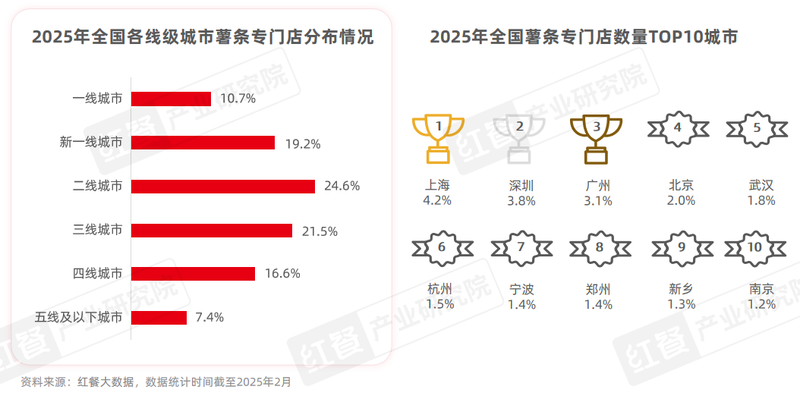

Especially in recent years, many specialty French fries stores have appeared on the market, and the number of stores is also growing rapidly. Red meal big data shows that as of February 2025, there are more than 2,000 specialty French fries stores nationwide, an increase of 45.1% from the end of 2023. The Red Food Industry Research Institute estimates that the market size of French fries specialty stores is expected to reach 20 billion yuan in 2025.

1. Three major factors, including favorable policies and high market awareness, promote the development of the French fries specialty store track

According to research and analysis by the Red Food Industry Research Institute, the reason why specialty French fries stores can develop rapidly is mainly driven by three factors.

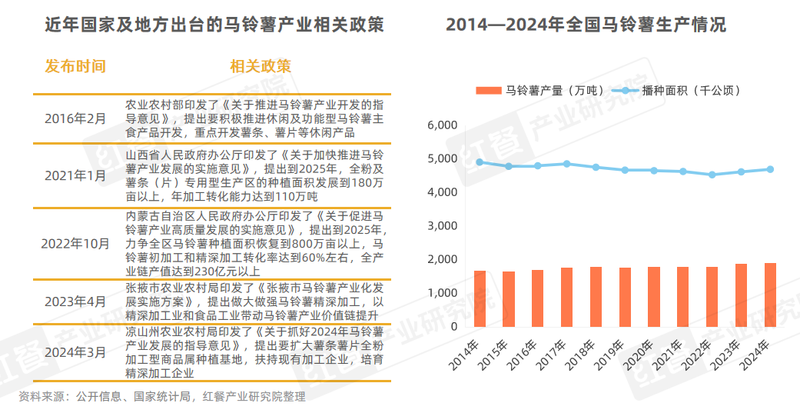

First, policies are conducive to the development of the French fries industry. In recent years, the national and local governments have attached great importance to the development of the potato industry and have successively issued a series of supporting policies to stabilize planting area, increase yield levels, cultivate deep processing enterprises, and accelerate the development of the entire potato industry chain.

Data from the National Bureau of Statistics show that my country’s potato planting area is basically stable at around 4,600 thousand hectares, and potato output in 2024 is estimated to exceed 19 million tons. At the same time, frozen fries that previously relied on imports have basically achieved localized production, and the annual output of frozen fries nationwide is about 500,000 tons.

Second, French fries have high market awareness and a wide audience. With the development of Western-style fast food, French fries have become deeply rooted in the hearts of Chinese consumers, and extensive market education has been completed. At the same time, the consumption scenarios of French fries are becoming increasingly diversified. They can be used as a staple food to satisfy hunger, and can also be used as a casual snack choice for afternoon tea and midnight snacks.

According to the Red Food Industry Research Institute, French fries are not only a must-have product for many Western fast food brands, but are also widely used in many catering fields such as rice fast food, noodle noodles, fried chicken kebabs, Chinese dinners, hot pot, freshly made drinks, desserts and desserts. The field is an important snack pairing for these track brands.

Third, specialty French fries stores have the three advantages of being simple and easy to obtain, high gross profit and easy to addicted. French fries have a high degree of standardization, simple production process, and are fried for cooking, which is addictive. Its main raw material is potatoes with large yields and low prices, with low costs and relatively high gross profit.

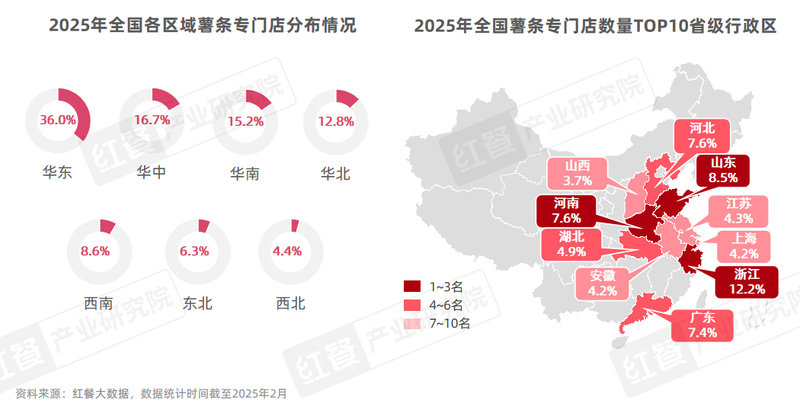

2. East China has the largest number of specialty French fries stores, and more than 50% of specialty French fries stores are located in second-tier cities and above.

Judging from the regional distribution of specialty chips stores, East China has the largest number of stores, accounting for 36.0%; followed by Central China, South China and North China, accounting for 16.7%, 15.2% and 12.8% respectively. In terms of provincial administrative regions, Zhejiang, Shandong, Henan, Hebei and Guangdong account for the top five in the number of specialty French fries stores.

3. The brand of specialty French fries stores has been established for a relatively short time, and the store size is mostly 10 or less

From the perspective of brand structure, as a subdivision of Western-style fast food tracks, the French fries specialty store is currently in the early stage of track development, and most brands have been established for a relatively short time. For example, Potato Corner, a French fries specialty store brand in the Philippines, will enter the Chinese market in 2022, and local brands such as putoto, Potato Gao, and Bangbang fried potatoes will all be established in 2023.

In addition, the size of the French fries specialty store brand is relatively small. Red Food Big Data shows that as of February 2025, 96.3% of the brand stores of French fries have 10 or less, with only Potato Corner, one-meter French fries, Shihuo freshly cut fried potatoes, and Kung Fu French fries. The number of brand stores has exceeded 50.

4. Nearly 80% of French fries specialty stores consume per capita in the range of 10 – 30 yuan, and brands are actively broadening the price band.

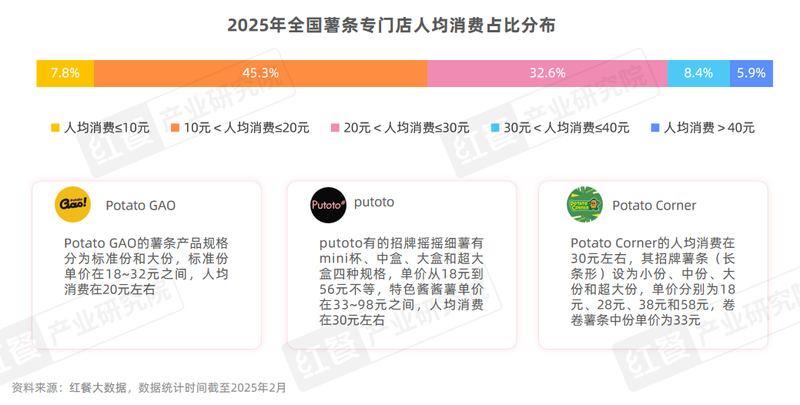

In terms of per capita consumption, the per capita consumption of nearly 80% of French fries specialty stores is concentrated in the range of 10 to 30 yuan. Among them, the number of stores with per capita consumption in the range of 10 – 20 yuan accounted for 45.3%, and the number of stores with per capita consumption in the range of 20 – 30 yuan accounted for 32.6%.

At present, there are some representative brands in various price ranges. The per capita consumption of brands such as Potato Corner, Putoto, SH4KE, AYSH and other brands is about 30 yuan, while the per capita consumption of brands such as One Rice Fries, Potato Gao, and Potato Fries is about 20 yuan.

In addition, many brands broaden the price band of French fries products by setting different portions or adding high-value ingredients and sauces. For example, the unit price of Potato Corner products ranges from 18 yuan to 58 yuan, and the unit price of putoto’s specialty sauced potatoes ranges from 33 yuan to 98 yuan.

French fries specialty stores actively innovate around multiple dimensions such as taste, shape, side dishes and ingredients

In recent years, the French fries specialty store brand has shown development highlights in terms of product innovation, store site selection, store decoration, brand communication, etc.; at the same time, upstream supply chain companies are also actively following up, providing stable quality for the French fries brand. Ingredients and rich taste options jointly promote the healthy and prosperous development of the French fries industry.

1. The brand innovates in all aspects of taste, shape, side dishes and ingredients to seek differentiation

Due to the high degree of standardization of French fries products, they are similar to the French fries products in Western fast food restaurants. In order to seek differentiation, the French fries specialty store brand actively carries out product innovation, striving to bring consumers a new taste buds experience from taste, shape, side dishes and even the French fries ingredients themselves.

In terms of taste innovation, the French fries specialty store brand not only introduces many classic Western flavors such as cheese onion flavor, honey mustard flavor, and black truffle flavor, but also introduces localized Chinese flavors, such as lychee Gongbao flavor, spicy incense pot flavor, spicy strip flavor, Sichuan pepper chicken flavor, etc.

In terms of shape innovation, unlike the single-shaped French fries in Western-style fast food restaurants, French fries specialty shops have a variety of French fries shapes, such as coarse potatoes, fine potatoes, rolled potatoes, and various shaped potatoes. Some brands have more than a dozen shapes to choose from.

In addition, some brands use other side dishes or upgrade the French fries ingredients themselves to enhance the value of their products. For example, putoto has launched products such as Wellington sausage sauce and potato sauce, spicy cheese stir-fried rice cake sauce; French chip man has launched lion’s head fries, Busan sausage fries, etc.;Potato Gao and other brands focus on fresh potatoes cut and fried, highlighting the freshness of ingredients, and some brands have also added sweet potato chips, taro chips and other products.

2. The brand actively expands its snack product line to meet the diversified needs of consumers

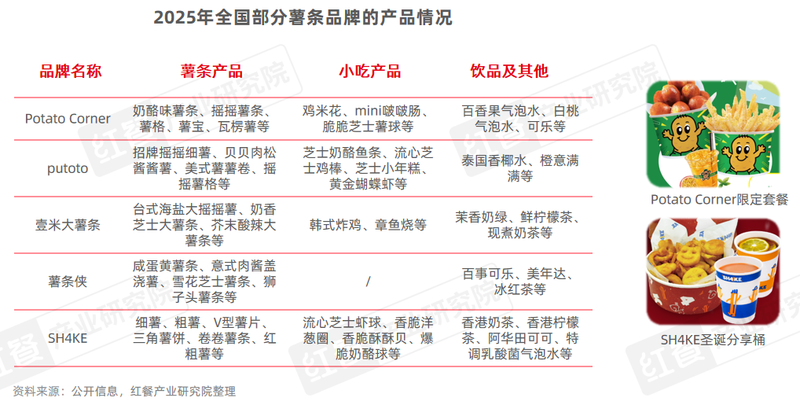

The French fries specialty store brand not only innovates French fries products, but also actively expands its snack, beverage and other product lines to meet the diversified needs of consumers.

For example, Potato Corner’s menu not only covers a variety of flavors of French fries, but also matches snacks such as chicken rice flower and mini Bo sausage, as well as drinks such as passion fruit sparkling water and white peach sparkling water;putoto focuses on two major French fries series such as shake fine potatoes and soy sauce potatoes, and also offers snacks and drinks such as cheese fish strips, cheese rice cakes, golden butterfly shrimp, Thai coconut water, and orange full; In addition to providing a variety of French fries and snacks, SH4KE also provides freshly made drinks such as Hong Kong milk tea, Hong Kong lemon tea, and Ahuatian cocoa.

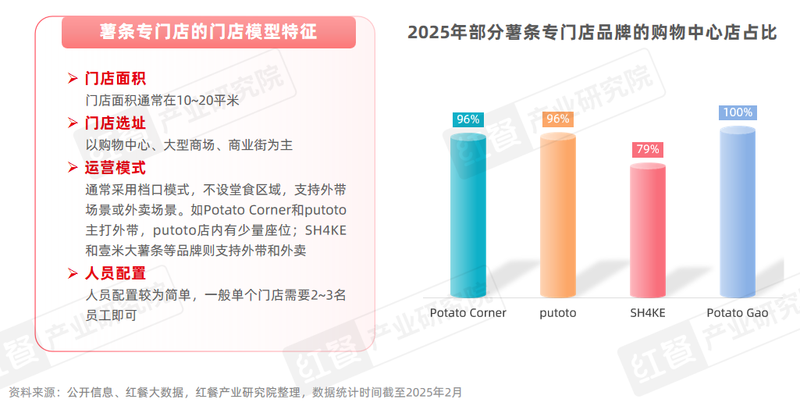

3. Specialty French fries stores are mainly based on stall models, and store locations favor high-traffic locations

From the perspective of store models, specialty French fries stores mostly adopt a stall model. The store area is usually 10 – 20 square meters. There is no in-room food area. It mainly focuses on take-out scenes, and some brands support take-out. At the same time, the staffing in the store is streamlined, only 2 to 3 employees are needed.

In terms of store location selection, the brand of specialty French fries stores tends to shopping centers, large shopping malls, commercial streets and other areas with large traffic. Red meal big data shows that as of February 2025, the proportion of shopping center stores of brands such as Potato Corner, Putoto, and Potato Gao all accounted for more than 90%. The high traffic in these locations provides a stable consumption base for specialty French fries shops with a customer unit price of 20 to 30 yuan.

4. The store decoration design is based on bright colors, which meets the aesthetic needs of contemporary young people.

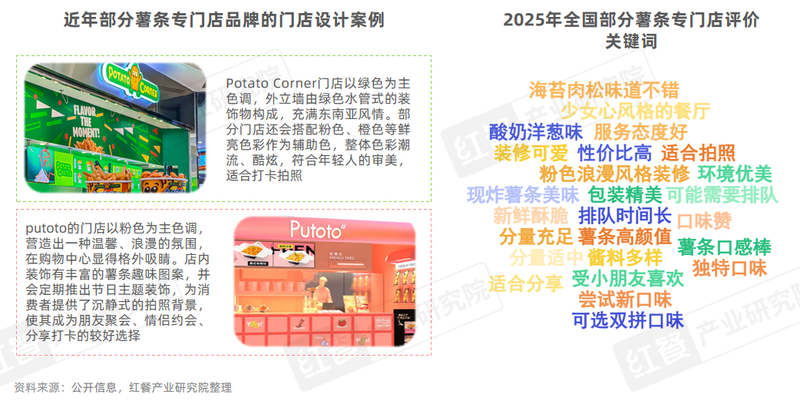

In terms of decoration and design, specialty French fries stores usually use bright and vibrant youthful elements as the main theme, such as red, pink, orange, yellow, green, etc., to form a certain visual impact. For example, Potato Corner’s stores are mainly green, and the exterior walls are composed of green water-pipe decorations, full of Southeast Asian style;putoto’s stores are mainly pink, creating a warm and romantic atmosphere.

The fashionable color matching of these French fries specialty shops meets the aesthetic needs of contemporary young people and is very suitable for taking photos and checking in. From the perspective of consumer evaluation keywords, keywords such as pink romantic decoration style, girly style restaurant, beautiful environment, and suitable for taking photos rank among the top.

5. The French fries supply chain is becoming increasingly mature, and upstream and downstream collaboration promotes industrial prosperity and development.

Previously, frozen French fries, an important raw material for French fries, mainly relied on imports. In recent years, with the promotion and cultivation of domestic potato varieties dedicated to French fries and the rise of the French fries processing industry, the French fries supply chain has become increasingly mature. International French fries supply giants such as Langweston, McCann Foods, and Aiweike have established French fries processing plants in our country, while local companies such as Kaida Hengye, Xuechuan Agriculture, and Langdun Xumi also have considerable production scale, and the production of frozen French fries has been fully localized.

In addition, many upstream seasoning companies can provide a wealth of sprinkles and sauces for French fries specialty store brands, and with their strong research and development capabilities and keen insight into market trends, they help French fries specialty store brands quickly achieve taste innovation.

conclusion

Currently, the application range of French fries in the catering market is becoming more and more extensive, from Western-style fast food to Chinese rice fast food, noodle noodles, hot pot, grilled fish, dinner, fried chicken kebabs, local snacks and even freshly made drinks and other catering tracks. In the future, as consumers ‘demand for French fries, a classic food, continues to increase, French fries will transcend the boundaries of traditional Western fast food and grow into one that can cover more diverse flavors, forms and experiences, and can also be integrated with multiple other tracks. A large track that integrates with other tracks.

However, we must also be soberly aware that the emerging field of French fries specialty stores is still in its infancy and faces many challenges in the development process, such as product homogenization, value need to be improved, and brand power need to be strengthened. To this end, the Red Food Industry Research Institute has put forward the following three suggestions for relevant practitioners: strengthen product innovation and create differentiation; strengthen brand building and increase brand awareness; enhance the sense of product value and ensure that consumers have a better experience. sense.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.