The end of the new tea drinking narrative should not be the capital market.

Lesson from Naixue and Chabai Dao: The bubble of new tea drinks is being paid for by each “Xiao Song”

Wen| brocade

At the beginning of 2023, after 29-year-old Xiao Song experienced resumes, interviews, and other notices over the past year, she felt that there was no hope of finding a job in Beijing again, so she resolutely packed her luggage and returned to her hometown.

While unemployed, she looked after the snack street near her hometown community. She watched as the takeout service became popular during the epidemic, and milk tea gradually became a must-have drink for people shopping and at home. After inspecting several beverage stores, she decided to choose a certain tea brand. The good policies of the headquarters made her feel that she made the right decision to come back. She had the only store within a kilometer nearby, and the business was very good. She hired two relatives to help her.

However, the prosperity did not last long. Another tea and beverage shop of the same brand opened near the community. The preferential policies of the new store affected her family’s business. Immediately afterwards, the nearby shopping mall declined, and her family’s snack street added a Shanghai aunt and a Chabaidao family. The franchise store scope policy once promised by the headquarters has expired after facing competition from multiple competitors.

There are actually 4 beverage shops opening in a small neighborhood, making business difficult. Xiao Song had no other choice but to suffer temporarily. On the other hand, the pressure on the other three stores might be greater than Xiao Song.

Xiao Song’s experience is a microcosm of the competition among tea shops in the sinking market in recent years. This third-tier city not far from Beijing is just an insignificant corner of the tea and drinking war in China.

In the past two or three years, in the narrative of public opinion, the stories of tea brands rushing into the capital market have been quite eye-catching. As everyone knows, this carries too many sorrows, joys and dislocations of young people in third-and fourth-tier towns like Xiao Song.

100,000 milk tea shops fought bloody battles in the capital market

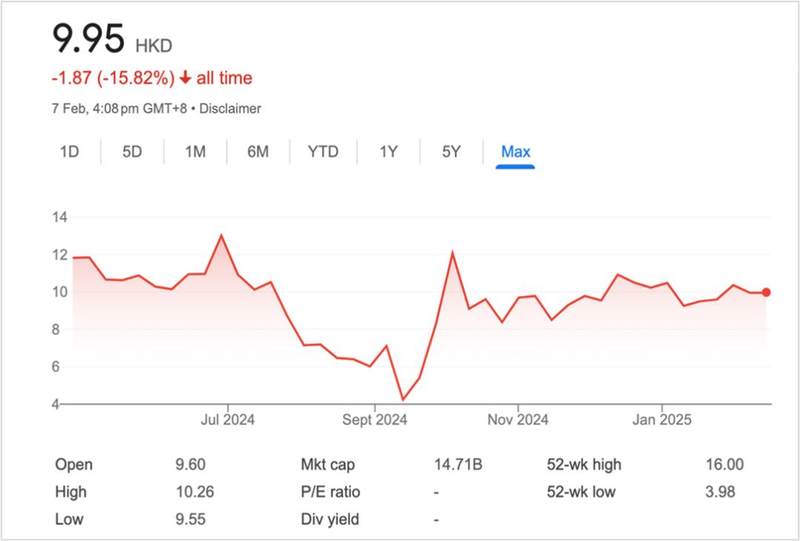

In 2021, Naixue’s tea will be the first to break out of the encirclement and be listed in Hong Kong. In April 2024, it will be listed in Chabai Road. However, judging from the stock price trend, Naixue’s tea has plummeted and disappointed investors, and Chabaidao has no signs of profit for the time being.

Stock price trend of Naixue’s tea after it went public

Share price trend after Chabaidao went public However, the capital market performance of these two tea drinks companies is not enough to dissuade domestic manufacturers who are eager to try. In the past few years, the winners of the new Chinese tea drinks track are queuing up to enter the Hong Kong Stock Exchange. Aunt Shanghai, Gu Ming, and Mixue Ice City have submitted prospectuses to the Hong Kong Stock Exchange.

Among them, Mixue Ice City’s first IPO was in September 2022. It submitted an A-share listing application to the China Securities Regulatory Commission, which coincided with the beginning of the implementation of the registration system. The company did not shift the Shenzhen Stock Exchange review, resulting in the failure of this sprint.

Then on January 2, 2024, Mixue Ice City moved to the Hong Kong Stock Exchange. Coincidentally, Gu Ming also submitted the prospectus on the same day. Immediately followed by Aunt Shanghai who delivered the form on February 14, 2024. Unfortunately, after waiting for six months, these three companies failed to ring the bell.

According to media reports, the failure to hit Hong Kong stocks in 2024 is largely related to the poor performance of Naixue’s tea, which has already been listed. The fate of Chabaidao, which will be listed in April 2024, will be broken immediately after listing seems to remind people to carefully consider the investment decisions of tea and beverage companies.

Mixue Ice City and Guming seem to be making a difference in the matter of listing. In January 2025, the two companies submitted listing applications to the Hong Kong Stock Exchange almost simultaneously again. Gu Ming took the lead in entering the formal IPO process and rang the bell on February 12, creating the third tea and beverage listed company in China.

The tea companies that have come to the table include Mixue Ice City, Guming, Shangshang Aunt, Chabaidao, Naixue Tea, as well as Bawang Tea Ji, Xi Tea and Tea Yanyue, which have no inferior stores and sales. In fact, around these industry leaders, there are also about 20 small and medium-sized tea and beverage companies.

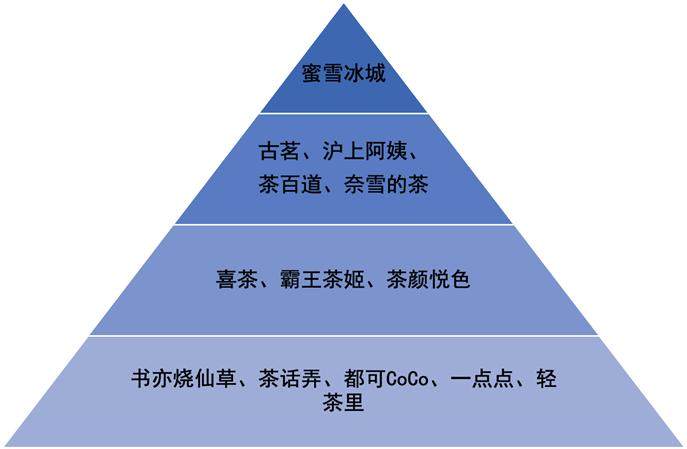

Based on the number of stores and the annual cup volume, we divide domestic tea drinks into four levels (see the figure below). Among them, companies that have listed and submitted prospectuses have clear data to check, and Xi Tea and Bawang Tea Ji can refer to third party data.

The ladder map of the scale of China’s tea drinks brands

The five companies at the top of the tower are and have already entered the poker table, and many players outside the door are also gearing up. Based on the prospectuses of the top five companies or the financial report for the second quarter of 2024, the number of tea and beverage shops nationwide has reached more than 73400. Based on the analysis of the report content, the number of stores for Bawang Tea Ji, Xi Tea and Cha Yan Yuese are 5000+, 4477 and 324 respectively. There are at least 83,000 stores for players up and down the table.

There is no doubt about the fierce competition. Although we often say that competition is a good thing, excessively fierce competition puts huge performance pressure on competitors.

The specific operating rule of business logic in the tea and beverage industry is that in order to sell more drinks for operating income, a store has limited offline coverage and can only rely on expanding stores to expand sales. In order to maintain sales under competition, companies dare not raise prices, and even need to discount in disguise most of the time.

The increase in the number of stores will lead to an increase in sales. Sales of GMV may not increase simultaneously, but costs will definitely increase accordingly. Every cup of coffee sold will be accompanied by raw material costs, store rent, labor costs, packaging costs, utilities, income tax, warehousing and logistics costs and possible express delivery costs.

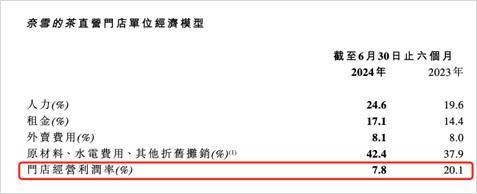

The cost issue is even more fatal for Naixue, which has a direct-sales model. The 2024 mid-year report shows that the store’s operating profit margin from January to June 2023 is 20.1%, and the store’s profit margin from January to June 2024 is only 7%.

Accompanying the decline in profit margins is a sharp increase in fixed costs related to each order such as labor costs, raw materials, and rent. Based on the store orders and sales of China Daily, the selling price of Naixue’s tea products dropped by 15% year-on-year.

What is even more helpless is that without these costs, sales GMV and performance revenue will not increase. This is the dead end of tea drinking companies under the pressure of fierce competition. This can be confirmed more from the second quarter mid-year report released by Chabaidao and Naixue’s tea.

Lessons from Naixue and Tea Baidao

naixue tea

The first is the top line and bottom line with operating results. In the first half of 2024, revenue fell by 2%, while a series of cost items such as material costs, marketing manpower, equipment depreciation and rent increased by about 10% year-on-year, and profits were severely compressed. Based on trade revenue, revenue in the second half of 2024 will drop by about 9% year-on-year compared with the second half of 2023.

Not only is its income worrying, but the number of stores in Naixue has almost stagnated from 2023 to 2024, and the number of stores at the end of the period increased by only 23.

This is the case in the corporate dimension. Operating profit down to the store level dropped by 65%, and operating profit margin dropped by 61%. Comparing the changes in the number of stores, we will find that the core factor in the decline in revenue is the decline in the volume of cups sold. This occurred even when the unit price per cup of tea dropped by 15%. On the track of freshly made tea, Naixue tea can be said to be There is no chance of winning.

Specific to the sale of goods, tea and beverage products in direct-sales stores dropped by 5.8 percentage points year-on-year, or 180 million yuan. In 2023, the baking products that contributed the second largest revenue dropped by 95.79 million, or 3.5 percentage points. Bottled beverages and others (revenue from franchising business and revenue from coffee, peripheral products, retail products and accompanying gifts, such as tea gift boxes, snacks, and holiday limited gift boxes) increased by 0.8 and 8.5 percentage points respectively.

In the first half of 2024, revenue from other products increased by 128% year-on-year, surpassing baking as the second largest source of income for Naixue’s tea. Judging from the footnote, the composition of other products is complex, and it is not yet possible to clarify the revenue contribution of specific items, let alone whether they can become a stable source of income for the company.

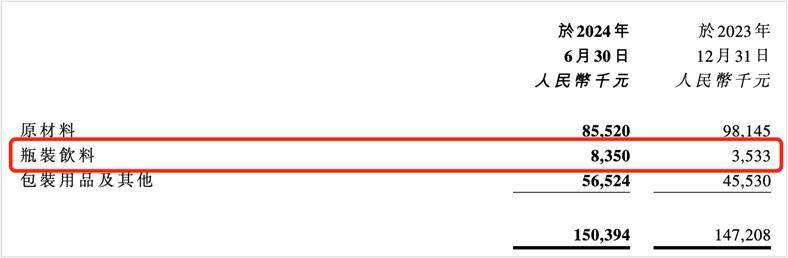

From the comparison of inventory items, we found that Naixue’s tea seems to be adjusting its product structure based on changes in revenue from various business lines. Specifically, raw materials directly related to tea drinking were 85.52 million yuan in the first half of the year, a year-on-year decrease of 13%. Inventories of bottled beverages increased by 136% year-on-year, while other items of packaging supplies related to other products increased by 24% year-on-year.

Naixue’s product structure adjustment may not be progressing badly, but it is unclear whether it will help Naixue reverse its current falling stock price. However, as a listed company can provide relatively clear performance data, we can also watch and see whether a traditional and established tea beverage participant can successfully transform.

Chabaidao

Chabaidao, the second largest share of tea drinks, has also entered an embarrassing period in the 2024 mid-term report. Its revenue dropped by 10% year-on-year, while its net profit margin dropped by 55%, and its gross profit margin dropped by 10%. Net profit fell even more sharply due to a 43% year-on-year increase in marketing, R & D administrative expenses during the period, and adjusted EBITDA profit margin fell by 27%.

Among the expense items, distribution and sales expenses, and research and development expenses both exceeded 100% year-on-year, and listing expenses of 71.97 million yuan were also incurred due to the listing in 2024.

Chabaidao is a franchise model, and its revenue comes from sales of tea raw materials, sales of production equipment, and income related to privileged use and franchise fees. In terms of division, revenue from tea-related goods, which accounted for nearly 90% of revenue, fell by 12%, while other businesses (equipment and franchise-related) increased by 6% year-on-year. However, this part of revenue has only accounted for 10% until 2024. It is still too early to become the second revenue pillar.

In the first half of 2024, in order to increase the number of stores opened and cope with external competition, Chabaidao increased its policy support for franchisees and preferential sales of goods and equipment to franchisees. This made it possible that although the number of new stores opened and the number of new franchisees Still growing, franchising fees and privilege royalties dropped year-on-year.

However, after dismantling the distribution of Chabaidao stores, we found that the greater factor in this policy preference was to deal with the competitive pressure from low-priced tea and beverage shops such as Mixue Ice City after the door store went to the sinking market.

In terms of the number of stores, the number of stores at the end of the first half of 2024 increased by 21% year-on-year. Among them, fourth-tier cities and below increased by 41% year-on-year, and the proportion of stores increased from 20.7% to 24.2%. The number of franchisees increased by 6% from 5392 to 5697 at the end of 2024.

It seems that the number of stores is increasing, but revenue per store is declining. Although the 24-year mid-year report did not directly give the revenue of a single store, we can see the changes in the revenue of newly opened stores each year from 2021 to 2023 from its prospectus: the current revenue of newly opened stores in 2021 is 7414 yuan, while in 2023 The revenue of newly opened stores dropped to 5985 yuan, a decrease of 19%.

In addition, the year-on-year decline in revenue and the increase in the number of stores also directly indicate a decline in single-store revenue.

Compared with the number of stores in franchised tea and beverage companies, the number of stores in third-tier cities and below is 1.8 times that of the other three stores. Chabaidao is the least popular among the four stores. Moreover, the deeper the market sinks, the lower people’s taste requirements for tea drinks, and the fiercer the competition between the four companies will be.

For small franchisees in small and fourth-tier cities, facing Mixue Ice City with nearly 20,000 stores, the headquarters does not have a clear attitude and come up with policies, which makes it difficult to give these small and medium-sized franchisees confidence. After all, the sinking market is the home court of Mixue Ice City.

At present, store sinking has almost become the only choice for tea and beverage companies to expand their stores. The compound growth rate of the number of stores in third-tier cities from 2021 to 2023 exceeds that of Chabaidao, while Mixue Ice City The three-year compound growth rate is close to 26%, which is also higher than Chabaidao.

For Chabaidao, it is not a good thing that its already strong competitors are moving faster than it.

The end of the new tea drinking narrative should not be the capital market

Naixue’s tea and tea courses have told a tragic story. Perhaps as attractive as the story of the new tea drink was at the beginning, the progress of this story is now so regrettable. Among them, Naixue’s tea has always adhered to the direct sales model. Faced with the strong attack power of the franchise model, Naixue has also begun to consider the franchise system, perhaps a little too late. In addition to having too many opponents, Naixue’s products are slightly less attractive than the current popular fried chicken Xi Tea and Bawang Tea Ji.

Not long ago, white-collar workers in first-tier cities and new first-tier cities have become accustomed to ordering a cup of wedding tea after lunch. Recently, they have changed to ordering a cup of overlord tea. Why did they change? They didn’t know that others were ordering Overlord Tea Girls, so they wanted to try them. Naixue’s tea (and tea hundreds) does not seem to be within their consideration. Maybe they will order it when they return to their hometown.

Competition also has dimensions. If the number of stores, the volume of cups sold, sku, and customer unit price are water-based competitions, then raw material procurement, production, storage and transportation efficiency, franchising system, franchisee management, and personnel training have long been sub-water competitions., which can determine how far a store can go.

Formal ordinary small stores constitute the grand narrative of today’s new tea drinks. When this narrative finally completed the closed loop in the capital market, there were Xiao Song or entrepreneurs or migrant workers who devoted their youth and dreamed of an ideal future. However, with the cracking sound, the bubble of the new tea drink was being paid for by each little Song.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.