Bitcoin emerged not to satisfy the “use value” in the traditional sense, but to deconstruct and reconstruct the value consensus in the global economy.

Written by: Daii

Today’s headline is modeled after an article in Newsweek 30 years ago,”The Internet? Bah!”(The Internet?Bah!)。

Bitcoin has fallen below 80,000 today, and you will soon be surrounded by various criticisms and doubts about Bitcoin. This article of mine wants to play the role of a thought vaccine so that you will not be surprised.

Although the title of the article is a bit playful, the topic we are going to discuss today is very academic.

The reason why we want to talk about this very academic topic is that a heavyweight expert took advantage of the collapse of Bitcoin to badmouth it, and said in a very academic tone that “Bitcoin has no real economic need.”

The expert is Jrgen Schaaf, an adviser to the European Central Bank. In an interview with Cointelegraph, he said,”Bitcoin reserves at the national level are a very risky idea.” Although it makes sense for the government to maintain reserves of energy resources such as oil and natural gas,”there is no real economic need” for Bitcoin because the cryptocurrency has no “actual economic necessity or related use.”

1. Bitcoin’s “sharp drop” echoes “no economic need”

Apparently, he said this to deny that Bitcoin could become a central bank reserve asset. Because, before, the governor of the Czech Central Bank had expressed the opposite view of him.

Schaaf supported his view by pointing out other shortcomings of Bitcoin, such as extreme volatility, possible illegal use, and vulnerability to manipulation. He believes that Bitcoin is inappropriate as a central bank reserve asset because it cannot provide a guarantee for currency stability and may instead encourage speculation and wealth redistribution.

As an adviser to the European Central Bank, Jrgen Schaaf has a profound financial background and high authority. His views have attracted widespread attention in the industry because he is not only the voice of a theorist, but also an important member of the European financial system. As one of the most important financial institutions in Europe, the European Central Bank’s decisions and positions directly affect the economic policies of the entire euro zone. As an adviser to the bank, Schaaf undoubtedly plays a pivotal role in monetary policy and economic governance.

When he said this, Bitcoin had just fallen below 90,000 yuan (February 25). Two days later (February 27), the price of Bitcoin fell below 85,000 yuan again. Today (February 28), it fell below 80,000 yuan again. It seems to perfectly echo Schaaf’s point of view.

However, if you have noticed, there is a fundamental cognitive bias in Schaaf’s assertion: “economic needs” are completely equated with industrialized society’s dependence on physical energy. His thinking still stays in the traditional paradigm of “oil is power” in the 20th century, but ignores the transition in demand in the era of digital civilization.

2. Bitcoin’s value comes from the new system

Bitcoin emerged not to satisfy the “use value” in the traditional sense, but to deconstruct and reconstruct the value consensus in the global economy. Bitcoin’s contribution to human civilization will far exceed that of oil.

Bitcoin is rewriting our definition of “need”. It represents not dependence on physical energy or traditional financial instruments, but the deep needs of the digital age for trust, decentralization, and security. Just like when the Internet was first born, it was once questioned that it “cannot produce food,” but it is the Internet that promotes global information flow, innovation and economic development.

Bitcoin creates a value transfer system that can transcend national borders, be decentralized, and do not require trust, which is almost unimaginable in traditional monetary systems.

Especially in developing countries, Bitcoin has become a financial haven for many people. Especially in the face of the crisis of hyperinflation and currency devaluation, many families have begun to use Bitcoin to preserve their wealth.

In Argentina, the peso has depreciated extremely rapidly in the past few years, and many people and companies have chosen to convert their funds into Bitcoin to cope with rising inflationary pressures. According to statistics, in Argentina, the penetration rate of Bitcoin is close to 10%, while in Venezuela, the proportion is even higher, exceeding 20%. These numbers reflect the huge “economic need” Bitcoin has for people in these countries.

In Venezuela, an ordinary family started investing in Bitcoin in 2016, and over the years, their funds have increased by more than 4000%. Bitcoin helped them save the wealth that should have evaporated during currency devaluation. It not only successfully preserved it, but even created opportunities for wealth appreciation.

In Nigeria, since 2019, although the Nigeria government has adjusted its regulatory policies on cryptocurrencies many times (including the 2021 bank ban and the 2023 policy easing), the transaction volume of Bitcoin has continued to grow, reflecting the strong public demand for it. Of course, the government of Nigeria was angry about this and sued Binan in its own court, claiming US$79.5 billion.

Not only that, Bitcoin’s decentralized nature gives it strong cross-border payment capabilities on a global scale. According to data, between 2018 and 2023, users of cross-border payments in Bitcoin increased by more than 200%.

Of course, not everyone sees the potential of Bitcoin, just as the value of the Internet could not always be recognized in 1995.

3. “Internet? Bah!” its enlightenment

The famous article in Newsweek in the United States is famous for its pessimistic predictions about the Internet. He questioned the commercial potential and social value of the Internet and made the following specific criticisms:

“There is no online database that can replace your daily newspaper.”& mdash; questioned the Internet’s threat to traditional media. “No CD-ROM can replace capable teachers.”& mdash; Doubt the role of technology in education. “No computer network will change the way government operates.”& mdash; denies the influence of the Internet on politics. “We are promised instant catalog shopping and get good deals with just a click. We will book flights, book restaurants and negotiate sales contracts online. Shops will become obsolete. So why does my local mall handle more business in an afternoon than the entire Internet handles in a month?” mdash; Questions the feasibility of e-commerce.

Now, as you already know, these criticisms above have become reality.

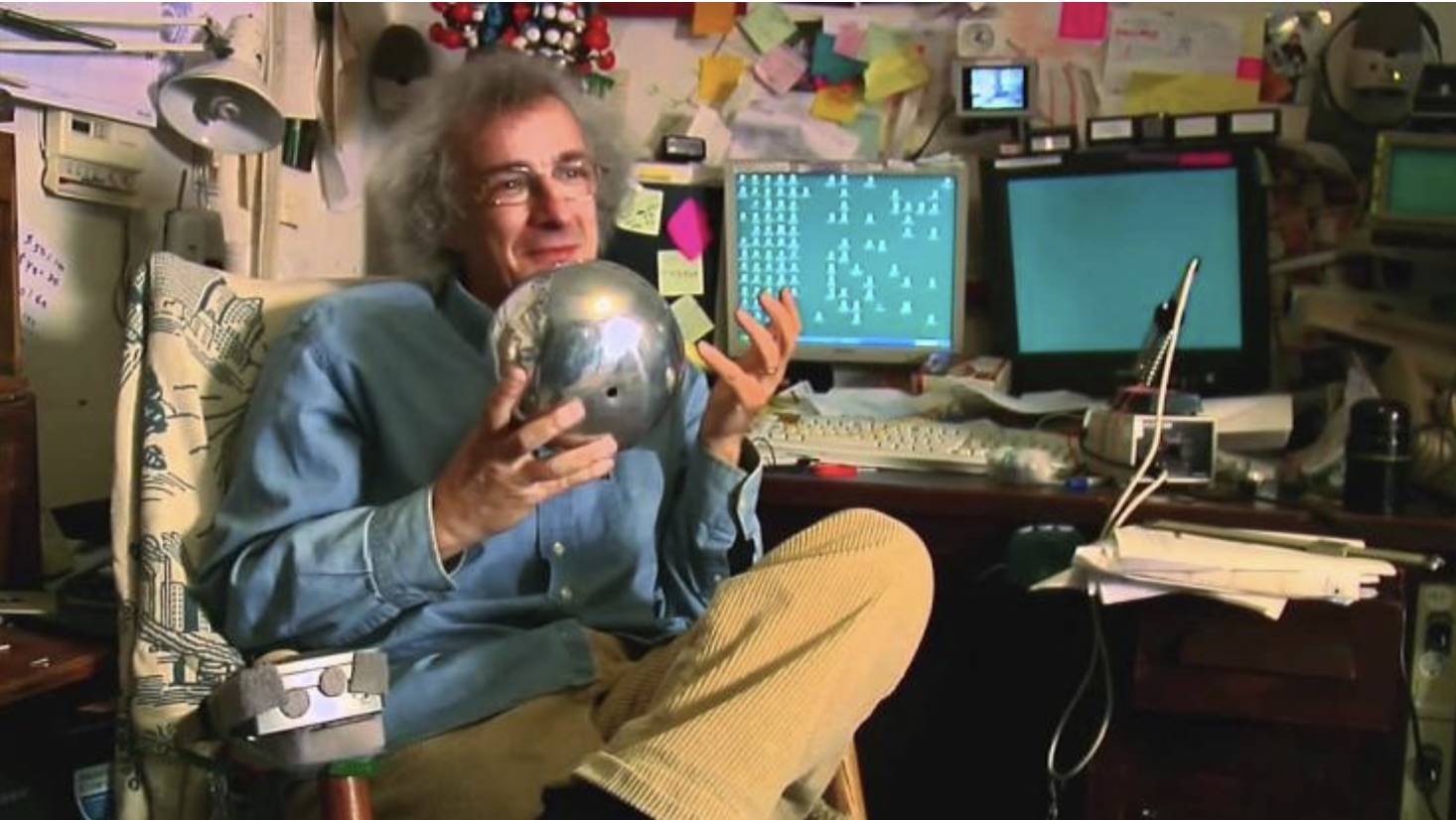

Clifford Stoll is the author of the article, an astronomer who is 74 years old. Stoll is no stubborn man. He reflected on his article as early as 2010 and admitted his mistake.

Stoll’s article is mentioned again today because it perfectly reflects the current critical logic of Bitcoin.

When European Central Bank adviser Jrgen Schaaf declared that “Bitcoin has no real economic need,” its essence is exactly the same as Stoll’s underlying thinking of denying the commercial value of the Internet, using the “needs” of industrial civilization to frame the paradigm revolution of digital civilization.

Just as Stoll couldn’t imagine Amazon’s trillion-dollar market value back then, traditional financial elites also had difficulty understanding how much productivity would be stimulated by the new economic demands created by Bitcoin such as “anti-censorship transactions”,”algorithmic trust” and “time sovereignty”.

conclusion

History never repeats itself, but it always rhymes.

The value of all disruptive technologies will eventually lay a solid foundation for growth in the cracks of the old paradigm.

The collapse and doubts of Bitcoin are like the darkest moments when the Internet bubble burst. In 2000, the Nasdaq index plunged 78%, and Amazon’s share price shrank 95%. The Wall Street Journal asserted that “e-commerce is destined to be a flash in the pan.” But today, 24 years later, the global e-commerce transaction volume has exceeded US$6 trillion, and Amazon’s market value is 30 times the peak of that year.

Price fluctuations can never negate the value revolution, just as tsunamis cannot negate the existence of the ocean.

The steam engine brought not faster carriages, but the entire railway era; Bitcoin changed not existing currencies, but a new value network based on mathematical consensus.

Looking back in 2025, Stoll-style misjudgments always remind us:

The real power of the technological revolution has never been in what it replaces, but in what new continents it creates.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern